Start with the partial model in the file Ch10 P23 Build a Model.xls on the textbooks Web

Question:

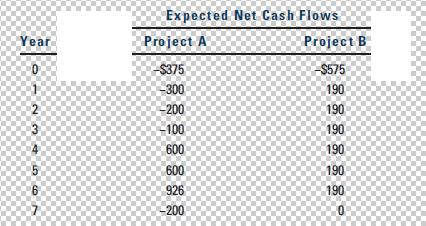

Start with the partial model in the file Ch10 P23 Build a Model.xls on the textbook’s Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects’ expected net cash flows are as follows:

a. If each project’s cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice?

b. Construct NPV profiles for Projects A and B.

c. What is each project’s IRR?

d. What is the crossover rate, and what is its significance?

e. What is each project’s MIRR at a cost of capital of 12%? At r = 18%?

f. What is the regular payback period for these two projects?

g. At a cost of capital of 12%, what is the discounted payback period for these two projects?

h. What is the profitability index for each project if the cost of capital is 12%?

Step by Step Answer:

Financial management theory and practice

ISBN: 978-1439078099

13th edition

Authors: Eugene F. Brigham and Michael C. Ehrhardt