Start with the partial model in the file Ch21 P07 Build a Model.xls on the textbooks Web

Question:

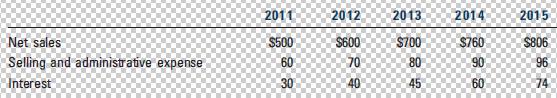

Start with the partial model in the file Ch21 P07 Build a Model.xls on the textbook’s Web site. Wansley Portal Inc., a large Internet service provider, is evaluating the possible acquisition of Alabama Connections Company (ACC), a regional Internet service provider. Wansley’s analysts project the following post-merger data for ACC (in thousands of dollars):

If the acquisition is made, it will occur on January 1, 2011. All cash flows shown in the income statements are assumed to occur at the end of the year. ACC currently has a capital structure of 30% debt, which costs 9%, but Wansley would increase that over time to 40%, costing 10%, if the acquisition were made. ACC, if independent, would pay taxes at 30%, but its income would be taxed at 35% if it were consolidated.ACC’s current market-determined beta is 1.4. The cost of goods sold, which includes depreciation, is expected to be 65% of sales, but it could vary somewhat. Required gross investment in operating capital is approximately equal to the depreciation charged, so there will be no investment in net operating capital. The risk-free rate is 7%, and the market risk premium is 6.5%. Wansley currently has $400,000 in debt outstanding.

a. What is the unlevered cost of equity?

b. What are the horizon value of the tax shields and the horizon value of the unlevered operations? What are the value of ACC’s operations and the value of ACC’s equity to Wansley’s shareholders?

Step by Step Answer:

Financial management theory and practice

ISBN: 978-1439078099

13th edition

Authors: Eugene F. Brigham and Michael C. Ehrhardt