The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $31,000, and it

Question:

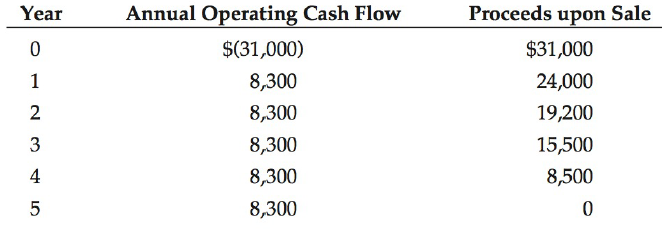

The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $31,000, and it is expected to generate net after-tax operating cash flows, of $8,300 per year. The truck has a 5-year expected life. The expected proceeds upon sale after tax adjustments for the truck are given below. The company's cost of capital is 11%.

a. Should the firm operate the truck until the end of its 5-year physical life? If not, what is its optimal economic life?

b. Would including the proceeds from selling an asset, in addition to operating cash flows, ever reduce the expected NPV and/ or IRR of a project?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Question Posted: