You are given the following set of data: a. Use a spreadsheet (or a calculator with a

Question:

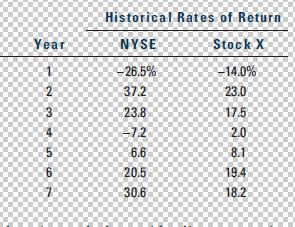

You are given the following set of data:

a. Use a spreadsheet (or a calculator with a linear regression function) to determine Stock X’s beta coefficient.

b. Determine the arithmetic average rates of return for Stock X and the NYSE over the period given. Calculate the standard deviations of returns for both Stock X and the NYSE.

c. Assume that the situation during Years 1 to 7 is expected to prevail in the future (i.e., ^r x ¼ ¯rx;^rM ¼ ¯rM, and both σX and bX in the future will equal their past values). Also assume that Stock X is in equilibrium—that is, it plots on the Security Market Line. What is the risk-free rate?

d. Plot the Security Market Line.

e. Suppose you hold a large, well-diversified portfolio and are considering adding to that portfolio either Stock X or another stock, Stock Y, which has the same beta as Stock X but a higher standard deviation of returns. Stocks X and Y have the same expected returns: ^r x ¼ ^ry ¼ 10:6%. Which stock should you choose?

Step by Step Answer:

Financial management theory and practice

ISBN: 978-1439078099

13th edition

Authors: Eugene F. Brigham and Michael C. Ehrhardt