Question: Begin with the partial model in the file Ch06 P14 Build a Model.xlsx on the textbooks Web site. a. The 2018 sales of Cumberland Industries

Begin with the partial model in the file Ch06 P14 Build a Model.xlsx on the textbook’s Web site.

a. The 2018 sales of Cumberland Industries were $455 million; operating costs (excluding depreciation) were equal to 85% of sales; net fixed assets were $67 million; depreciation amounted to 10% of net fixed assets;

interest expenses were $8.55 million; the state-plus-federal corporate tax rate was 40%; and Cumberland paid 25% of its net income out in dividends. Given this information, construct Cumberland’s 2018 income statement. Also calculate total dividends and the addition to retained earnings.

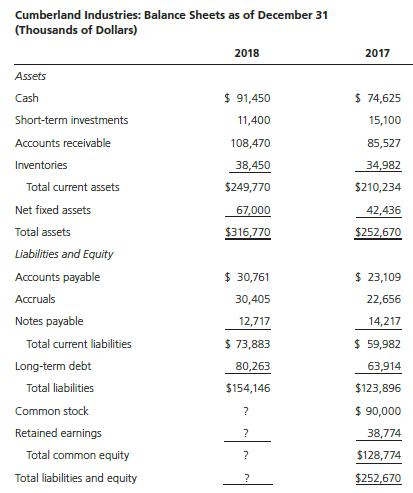

b. The partial balance sheets of Cumberland Industries are shown here.

Cumberland issued $10 million of new common stock in 2018. Using this information and the results from part

a, fill in the missing values for common stock, retained earnings, total common equity, and total liabilities and equity.

c. Construct the statement of cash flows for 2018.

Cumberland Industries: Balance Sheets as of December 31 (Thousands of Dollars) 2018 2017 Assets Cash $ 91,450 $ 74,625 Short-term investments 11,400 15,100 Accounts receivable 108,470 85,527 Inventories 38,450 34,982 Total current assets $249,770 $210,234 Net fixed assets 67,000 42,436 Total assets $316,770 $252,670 Liabilities and Equity 30,405 12,717 Accounts payable $ 30,761 Accruals Notes payable Total current liabilities $ 73,883 Long-term debt Total liabilities 80,263 $154,146 $ 23,109 22,656 14,217 $ 59,982 63,914 $123,896 $ 90,000 38,774 Common stock ? Retained earnings ? Total common equity ? Total liabilities and equity ? $252,670 $128,774

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts