Question: Begin with the partial model in the file Ch06 P21 Build a Model.xlsx on the textbooks Web site. a. Using the financial statements shown here

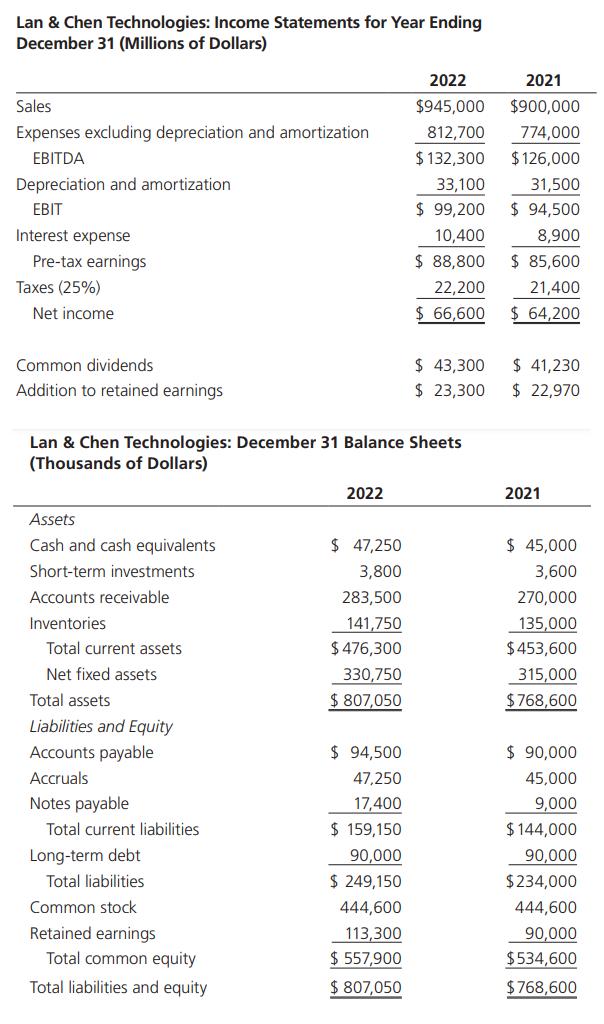

Begin with the partial model in the file Ch06 P21 Build a Model.xlsx on the textbook’s Web site. a. Using the financial statements shown here for Lan & Chen Technologies, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital for 2022. The federal-plus-state tax rate is 25%. b. Assume there were 15 million shares outstanding at the end of 2021, the year-end closing stock price was $65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 2022.

Lan & Chen Technologies: Income Statements for Year Ending December 31 (Millions of Dollars) Sales Expenses excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest expense Pre-tax earnings Taxes (25%) Net income Common dividends Addition to retained earnings Assets Cash and cash equivalents Short-term investments. Accounts receivable Lan & Chen Technologies: December 31 Balance Sheets (Thousands of Dollars) Inventories Total current assets Net fixed assets Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 2022 $ 47,250 3,800 283,500 141,750 $476,300 330,750 $ 807,050 $ 94,500 47,250 17,400 $ 159,150 2022 $945,000 812,700 $132,300 90,000 $ 249,150 444,600 113,300 $ 557,900 $ 807,050 33,100 $ 99,200 10,400 $ 88,800 22,200 $ 66,600 $ 43,300 $ 23,300 2021 $900,000 774,000 $126,000 31,500 $ 94,500 8,900 $ 85,600 21,400 $ 64,200 $ 41,230 $ 22,970 2021 $ 45,000 3,600 270,000 135,000 $453,600 315,000 $768,600 $ 90,000 45,000 9,000 $144,000 90,000 $234,000 444,600 90,000 $534,600 $768,600

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

ANSWER a Net Operating Working Capital NOWC Current Assets Accounts Payable Accruals NOWC for ... View full answer

Get step-by-step solutions from verified subject matter experts