Donna Jamison, a 2011 graduate of the University of Florida, with 4 years of banking experience, was

Question:

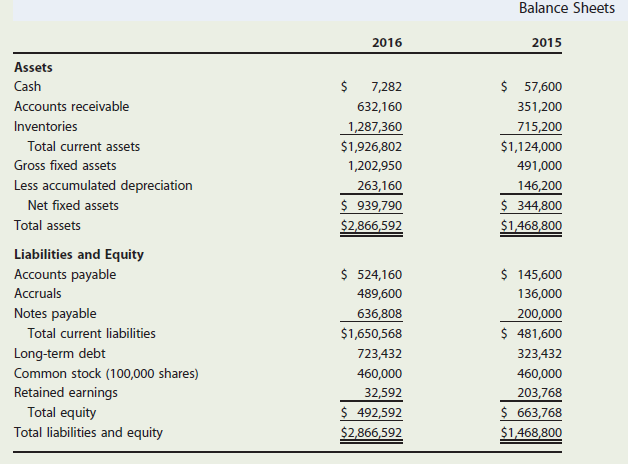

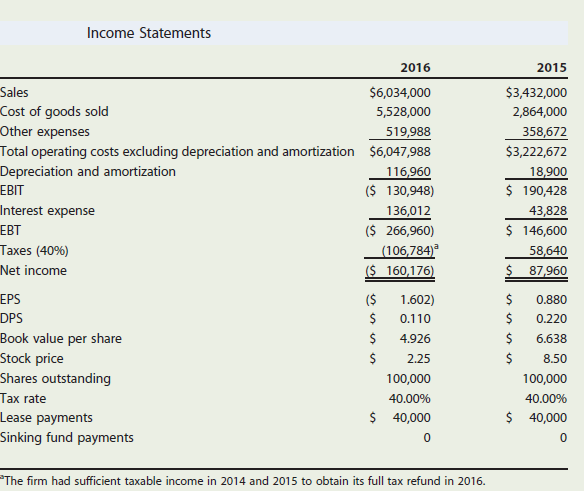

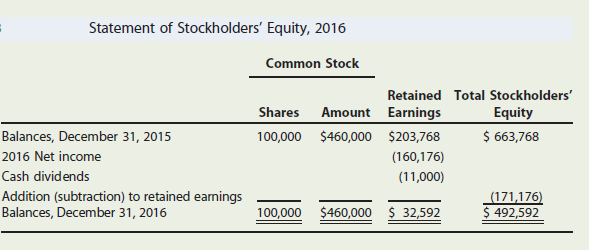

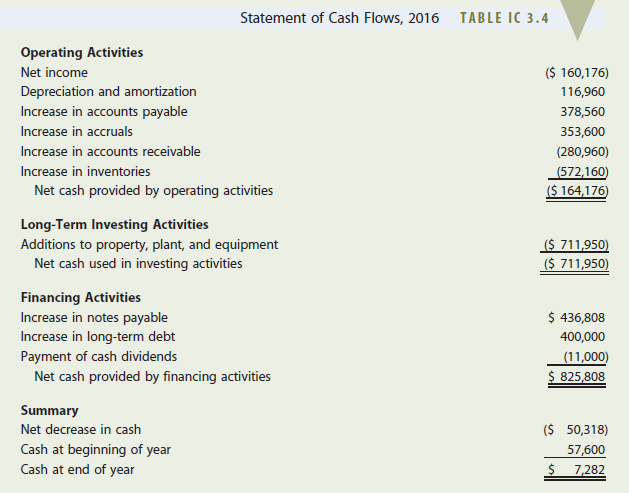

The company doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. D€™Leon€™s results were not satisfactory, to put it mildly. Its board of directors, which consisted of its president, vice president, and major stockholders (all of whom were local businesspeople), was most upset when directors learned how the expansion was going. Unhappy suppliers were being paid late; and the bank was complaining about the deteriorating situation and threatening to cut off credit. As a result, Watkins was informed that changes would have to be made€”and quickly; otherwise, he would be fired. Also, at the board€™s insistence, Donna Jamison was brought in and given the job of assistant to Fred Campo, a retired banker who was D€™Leon€™s chairperson and largest stockholder. Campo agreed to give up a few of his golfing days and help nurse the company back to health, with Jamison€™s help. Jamison began by gathering the financial statements and other data given in Tables IC 3.1, IC 3.2, IC 3.3, and IC 3.4. Assume that you are Jamison€™s assistant. You must help her answer the following questions for Campo. (Note: We will continue with this case in Chapter 4, and you will feel more comfortable with the analysis there. But answering these questions will help prepare you for Chapter 4. Provide clear explanations.)

a. What effect did the expansion have on sales, after-tax operating income, net operating working capital (NOWC), and net income?

b. What effect did the company€™s expansion have on its free cash flow?

c. D€™Leon purchases materials on 30-day terms, meaning that it is supposed to pay for purchases within 30 days of receipt. Judging from its 2016 balance sheet, do you think that D€™Leon pays suppliers on time? Explain, including what problems might occur if suppliers are not paid in a timely manner.

d. D€™Leon spends money for labor, materials, and fixed assets (depreciation) to make products€”and spends still more money to sell those products. Then the firm makes sales that result in receivables, which eventually result in cash inflows. Does it appear that D€™Leon€™s sales price exceeds its costs per unit sold? How does this affect the cash balance?

e. Suppose D€™Leon€™s sales manager told the sales staff to start offering 60-day credit terms rather than the 30-day terms now being offered. D€™Leon€™s competitors react by offering similar terms, so sales remain constant. What effect would this have on the cash account? How would the cash account be affected if sales doubled as a result of the credit policy change?

f. Can you imagine a situation in which the sales price exceeds the cost of producing and selling a unit of output, yet a dramatic increase in sales volume causes the cash balance to decline? Explain.

g. Did D€™Leon finance its expansion program with internally generated funds (additions to retained earnings plus depreciation) or with external capital? How does the choice of financing affect the company€™s financial strength?

h. Refer to Tables IC 3.2 and IC 3.4. Suppose D€™Leon broke even in 2016 in the sense that sales revenues equaled total operating costs plus interest charges. Would the asset expansion have caused the company to experience a cash shortage that required it to raise external capital? Explain.

i. If D€™Leon starts depreciating fixed assets over 7 years rather than 10 years, would that affect (1) the physical stock of assets, (2) the balance sheet account for fixed assets, (3) the company€™s reported net income, and (4) the company€™s cash position? Assume that the same depreciation method is used for stockholder reporting and for tax calculations and that the accounting change has no effect on assets€™ physical lives.

j. Explain how earnings per share, dividends per share, and book value per share are calculated and what they mean. Why does the market price per share not equal the book value per share?

k. Explain briefly the tax treatment of (1) interest and dividends paid, (2) interest earned and dividends received, (3) capital gains, and (4) tax loss carry backs and carry forwards. How might each of these items affect D€™Leon€™s taxes?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-1305635937

Concise 9th Edition

Authors: Eugene F. Brigham