Malone Feed and Supply Company buys on terms of 1/10, net 30, but it has not been

Question:

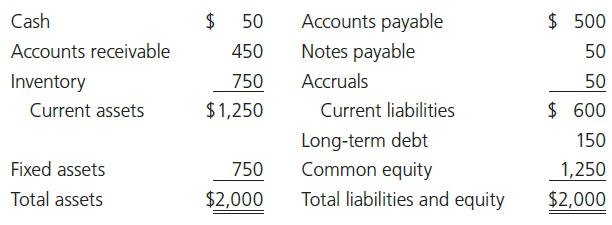

Malone Feed and Supply Company buys on terms of 1/10, net 30, but it has not been taking discounts and has actually been paying in 60 rather than 30 days. Assume that the accounts payable are recorded at full cost, not net of discounts. Malone’s balance sheet follows (thousands of dollars):

Malone’s suppliers are threatening to stop shipments unless the company begins making prompt payments (that is, paying within 30). The firm can borrow on a 1-year note (call this a current liability) from its bank at a rate of 15% discount interest with a 20% compensating balance required.

(Malone’s $50,000 in cash is needed for transactions; it cannot be used as part of the compensating balance.)

a. How large would the accounts payable balance be if Malone takes discounts?

If it does not take discounts and pays in 30 days?

b. How large must the bank loan be if Malone takes discounts? If Malone doesn’t take discounts?

c. What are the nominal and effective costs of costly trade credit? What is the effective cost of the bank loan? Based on these costs, what should Malone do?

d. Assume Malone forgoes the discount and borrows the amount needed to become current on its payables. Construct a projected balance sheet based on this decision. (Hint: You will need to include an account called “prepaid interest” under current assets.)

e. Now assume that the $500,000 shown on the balance sheet is recorded net of discounts. How much would Malone have to pay its suppliers in order to reduce its accounts payable to $250,000? If Malone’s tax rate is 40%, then what is the effect on its net income due to the lost discount when it reduces its accounts payable to $250,000? How much would Malone have to borrow? Construct a projected balance sheet based on this scenario.

Step by Step Answer:

Intermediate Financial Management

ISBN: 9781337395083

13th Edition

Authors: Eugene F. Brigham, Phillip R. Daves