Depreciation expense is a significant cost for companies in which plant assets are a high proportion of

Question:

Depreciation expense is a significant cost for companies in which plant assets are a high proportion of assets. The amount of depreciation expense in a given year is affected by estimates of useful life and choice of depreciation method. In 2010, Century Steelworks Company, a major integrated steel producer, changed the estimated useful lives for its major production assets. It also changed the method of depreciation for other steel-making assets from straight-line to the production method.

In its 2010 annual report, Century Steelworks makes the following statement:

A recent study conducted by management shows that actual yearsin-service figures for our major production equipment and machinery are, in most cases, higher than the estimated useful lives assigned to these assets. We have recast the depreciable lives of such assets so that equipment previously assigned a useful life of 8 to 26 years now has an extended depreciable life of 10 to 32 years.

The report goes on to explain the new production method of depreciation, as follows:

[The method] recognizes that depreciation of production equipment and machinery correlates directly to both physical wear and tear and the passage of time. The production method of depreciation, which we have now initiated, more closely allocates the cost of these assets to the periods in which products are manufactured.

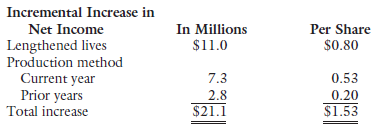

The report summarizes the effects of the changes in estimated useful lives and depreciation method on the year 2010 as shown in the following table:

During 2010, Century Steelworks reported a net loss of $83,156,500 ($6.03 per share). Depreciation expense for 2010 was $87,707,200.

In explaining the changes the company has made, the controller of Century Steelworks was quoted in an article in Business Journal as follows: “There is no reason for Century Steelworks to continue to depreciate our assets more conservatively than our competitors do.” But the article also quotes an industry analyst who argues that by slowing its method of depreciation, Century Steelworks could be viewed as reporting lower-quality earnings.

1. Explain the accounting treatment when there is a change in the estimated lives of depreciable assets. What circumstances must exist for the production method to produce the effect it did in relation to the straight-line method? What would Century Steelworks’ net income or loss have been if the changes had not been made? What might have motivated management to make the changes?

2. What does the controller of Century Steelworks mean when he says that Century had been depreciating “more conservatively than our competitors do”? Why might the changes at Century Steelworks indicate, as the analyst asserts, “lower-quality earnings”? What risks might Century face as a result of its decision to use the production method of depreciation?

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson