Question: Nike, Inc.s principal business activity involves the design, development, and worldwide marketing of athletic footwear, apparel, equipment, accessories, and services for serious and recreational athletes.

Nike, Inc.€™s principal business activity involves the design, development, and worldwide marketing of athletic footwear, apparel, equipment, accessories, and services for serious and recreational athletes. Nike boasts that it is the largest seller of athletic footwear and apparel in the world. Nike sells products to retail accounts, through Nike-owned retail stores and Internet websites, and through a mix of independent distributors and licensees throughout the world. Nearly all of Nike€™s footwear and apparel products are produced in Asia (Vietnam, China, and Indonesia) and elsewhere outside of the U.S., while equipment products are produced both in the U.S. and abroad. For more information, visit Nike€™s investor relations website page: www.investors.nike.com/Home/default.aspx.

This case uses Nike€™s financial statements and excerpts from its notes to review important concepts underlying the three principal financial statements (balance sheet, income statement, and statement of cash flows) and relations among them. The case also introduces tools for analyzing financial statements.

Industry Economics

Product Lines

Industry analysts debate whether the athletic footwear and apparel industry is a performance-driven industry or a fashion-driven industry. Proponents of the performance view point to Nike€™s dominant market position, which results in part from continual innovation in product development. Proponents of the fashion view point to the difficulty of protecting technological improvements from competitor imitation, the large portion of total expenses comprising advertising, the role of sports and other personalities in promoting athletic shoes, and the fact that a high percentage of athletic footwear and apparel consumers use the products for casual wear rather than athletic purposes.

Growth

There are only modest growth opportunities for footwear and apparel in the United States. Concern exists with respect to volume increases (how many pairs of athletic shoes do consumers want) and price increases (will consumers continue to pay prices for innovative athletic footwear that is often twice as costly as other footwear).

Athletic footwear companies have diversified their revenue sources in two directions in recent years. One direction involves increased emphasis on international sales. With dress codes becoming more casual in Europe and East Asia, industry analysts view international markets as the major growth markets during the next several years. Increased emphasis on soccer (European football) in the United States aids companies such as Adidas that have reputations for quality soccer footwear.

The second direction for diversification is sports and athletic apparel. The three leading athletic footwear companies capitalize on their brand-name recognition and distribution channels to create lines of sportswear and equipment that coordinate with their footwear. Team uniforms and matching apparel for coaching staffs and fans have become a major growth avenue.

Marketing

Athletic footwear and sportswear companies sell their products to consumers through various independent department, specialty, and discount stores, as well as through online sales channels. Their sales forces educate retailers on new product innovations, store display design, and similar activities. The market shares of Nike and the other major brand-name producers dominate retailers€™ shelf space, and slower growth in sales makes it increasingly difficult for the remaining athletic footwear companies to gain market share. The slower growth also has led the major companies to increase significantly their advertising and payments for celebrity endorsements. Many footwear companies, including Nike, have opened their own retail stores, as well as factory outlet stores for discounted sales of excess inventory.

Athletic footwear and sportswear companies have typically used independent distributors to market their products in other countries. With increasing brand recognition and anticipated growth in international sales, these companies have recently acquired an increasing number of their distributors to capture more of the profits generated in other countries and maintain better control of international marketing.

Nike Strategy

Nike targets the serious athlete as well as the recreational athlete with performance-driven footwear, apparel, and equipment. The firm has steadily expanded the scope of its product portfolio from its primary products of high-quality athletic footwear for running, training, basketball, soccer, and casual wear to encompass related product lines such as sports apparel, bags, equipment, balls, eye wear, timepieces, and other athletic accessories. In addition, Nike has expanded its scope of sports, now offering products for swimming, baseball, cheer leading, football, golf, lacrosse, tennis, volleyball,skateboarding, and other leisure activities. In recent years, the firm has emphasized growth outside the United States. Nike also has grown by acquiring other apparel companies, including ColeHaan (dress and casual footwear), Converse (athletic and casual footwear and apparel), Hurley(apparel for action sports such as surfing, skateboarding, and snowboarding), and Umbro (footwear, apparel, and equipment for soccer).

To maintain its technological edge, Nike engages in extensive research at its research facilities in Beaverton, Oregon. It continually alters its product line to introduce new footwear, apparel, equipment, and evolutionary improvements in existing products.

The Following exhibits present information for Nike:

Exhibit 1.24: Consolidated balance sheets for 2014, 2015, and 2016

Exhibit 1.25: Consolidated income statements for 2014, 2015, and 2016

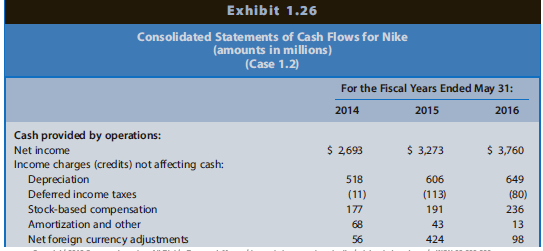

Exhibit 1.26: Consolidated statements of cash flows for 2014, 2015, and 2016

Exhibit 1.27: Excerpts from the notes to Nike€™s financial statements

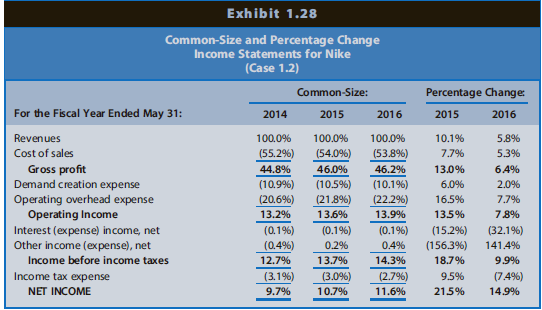

Exhibit 1.28: Common-size and percentage change income statements

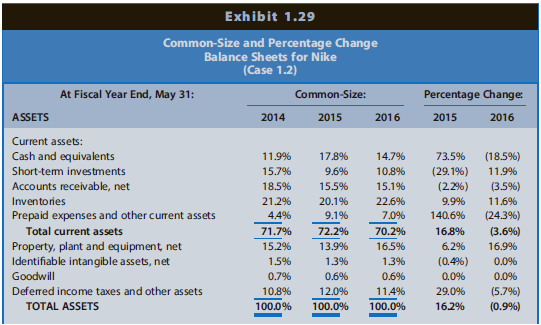

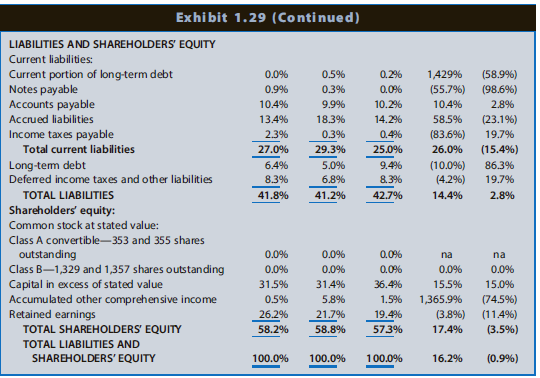

Exhibit 1.29: Common-size and percentage change balance sheets

REQUIRED

Study the financial statements and notes for Nike and respond to the following questions.

Exhibit 1.27

Excerpts from Notes to Consolidated Financial Statements for Nike

(amounts in millions)

(Case 1.2)

Excerpts from the Summary of Significant Accounting Policies

- Revenue Recognition: Nike recognizes wholesale revenues when title and the risks and rewards of ownership have passed to the customer, based on the terms of sale. This occurs upon shipment or upon receipt by the customer depending on the country of the sale and the agreement with the customer. Retail store revenues are recorded at the time of sale and online store revenues are recorded upon delivery to the customer. Provisions for post-invoice sales discounts, returns and miscellaneous claims from customers are estimated and recorded as a reduction to revenue at the time of sale.

- Allowance for Uncollectible Accounts Receivable: Accounts receivable, net consist primarily of amounts receivable from customers. The Company makes ongoing estimates relating to the collectability of its accounts receivable and maintains an allowance for estimated losses resulting from the inability of its customers to make required payments. In determining the amount of the allowance, the Company considers historical levels of credit losses and makes judgments about the creditworthiness of significant customers based on ongoing credit evaluations. The allowance for uncollectible accounts receivable was $43 million and $78 million at May 31, 2016 and 2015, respectively.

- Demand Creation Expense: Demand creation expense consists of advertising and promotion costs, including costs of endorsement contracts, television, digital and print advertising, brand events and retailer and presentation. Advertising production costs are expensed the first time an advertisement is run.

- Inventory Valuation: Inventories are stated at lower of cost or market and valued on either an average or specific identification cost basis. For inventories in transit that represent direct shipments to customers, the related inventory and cost of sales are recognized on a specific identification basis. Inventory costs primarily consist of product cost from the Company€™s suppliers, as well as inbound freight, import duties, taxes, insurance and logistics and other handling fees.

- Property, Plant and Equipment and Depreciation: Property, plant and equipment are recorded at cost. Depreciation is determined on a straight-line basis for buildings and leasehold improvements over 2 to 40 years and for machinery and equipment over 2 to 15 years.

- Identifiable Intangible Assets and Goodwill: This account represents the excess of the purchase price of acquired businesses over the market values of identifiable net assets, net of amortization to date on assets with limited lives.

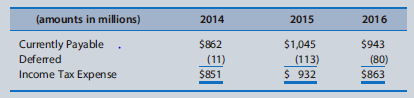

- Income Taxes: The Company accounts for income taxes using the asset and liability method. This approach requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities. Income tax expense includes the following:

- Stock Repurchases: Nike repurchases outstanding shares of its common stock each year and retires them. Any difference between the price paid and the book value of the shares appears as an adjustment of retained earnings.

Income Statement

a. Identify when Nike recognizes revenues. Does this timing of revenue recognition seem appropriate?Explain.

b. Identify the cost-flow assumption(s) that Nike uses to measure cost of goods sold. Does Nike€™s choice of cost-flow assumption(s) seem appropriate? Explain.

c. Nike reports property, plant, and equipment on its balance sheet and discloses the amount of depreciation for each year in its statement of cash flows. Why doesn€™t depreciation expense appear among its expenses on the income statement?

d. What does €˜€˜demand creation expense€™€™ represent?

e. Identify the portion of Nike€™s income tax expense of $863 million for 2016 that is currently payable to governmental entities and the portion that is deferred to future years. Why is the amount currently payable to governmental entities in 2016 greater than the income tax expense?

Balance Sheet

f. Why do accounts receivable (net) appear net of allowance for doubtful accounts? Identify the events or transactions that cause the allowance account to increase or decrease.

g. What is the largest asset (in dollar amount) on Nike€™s balance sheet? How does this asset relate to Nike€™s strategy?

h. Identify the depreciation method(s) that Nike uses for its buildings and equipment. Does Nike€™s choice of depreciation method(s) seem appropriate?

i. Nike includes identifiable Intangible Assets on its balance sheet. Does this account include the value of Nike€™s brand name and Nike€™s €˜€˜swoosh€™€™ trademark? Explain.

Statement of Cash Flows

j. Why does the amount of net income differ from the amount of cash flow from operations?

k. Why does Nike add depreciation expense back to net income when calculating cash flow from operations?

l. Why does Nike subtract increases in accounts receivable from net income when calculating cash flow from operations for 2016?

m. Why does Nike adjust net income by subtracting increases in inventory and adding decreases in inventory when calculating cash flow from operations?

n. When calculating cash flow from operations, why does Nike adjust net income by adding increases and subtracting decreases in accounts payable?

o. Cash flow from operations exceeded net income during fiscal 2015, but not during fiscal 2016. Why?What caused the big drop in cash flows provided by operations from 2015 to 2016?

p. What were Nike€™s primary financing activities during these three years?

Relations between Financial Statement Items

q. Compute the amount of cash collected from customers during 2016.

r. Compute the amount of cash payments made to suppliers of merchandise during 2016.

s. Reconcile the change in retained earnings during 2016.

Interpreting Financial Statement Relations

t. Exhibit 1.28 presents common-size and percentage change income statements for Nike for 2014, 2015, and 2016. What are some reasons for the increases in the net income/sales revenue percentages for Nike between 2014 and 2015, and between 2015 and 2016?

u. Exhibit 1.29 presents common-size and percentage change balance sheets for Nike at the end of 2014, 2015, and 2016. What is the likely explanation for the relatively small percentages for property, plant, and equipment?

v. What is the likely explanation for the relatively small percentages for notes payable and long-term debt?

Exhibit 1.24 Consolidated Bal ance Sheet for Nike, Inc. (amounts in milions) (Case 1.2) At Fisal Year End, May 31: 2014 2015 2016 ASSETS Current assets: $ 2220 $ 3852 $ 3,138 Cash and equihelents Short tem investments Accounts mceivable, net 2922 2072 2319 3434 3358 3241 3947 818 Inventories 4,337 4838 Prepaid expenses andother arrent assets Total aurrent assets 1968 $15,587 1489 $13,341 2834 $15,025 3,520 Property, pant and equipment, n Identifiable intangible assets, net net 3011 282 281 281 Goodwill 131 131 131 Defered income taes and other assets 2,006 $18.594 2,587 $21,597 2439 TOTAL ASSETS $21,396 LIABILITIES AND SHAREHOLDE RS' EQUITY Current liabilities Cument portion of bng-tem debt Notes payable Accounts payable $ 107 44 167 74 1,930 2131 2191 Accnued liabilites 2,491 3949 3,037 Income txes payebe 432 $ 5,027 71 85 $ 6,332 $ 5,358 2010 1,770 Total aurrent liabilities Long tem debe Defered income taxes and other liabilties 1,199 1,079 1,544 $ 7,770 1479 $ 8,890 TOTAL LIA BILITIES $ 9,138 Shareholders equity: Common stock at stated vakue: Cas A convertible 353 and 355 shares outstanding Cas B-1329 and 1,357 shares outstanding Capital in excess of stated value Accumulated other comprehensive income Retained earnings TOTAL SHARE HOLDERS' EQUITY 3 3 3 6773 7,786 85 1246 318 4871 4685 4,151 $10,824 $12,707 $21,597 $12,258 $21,396 TOTAL LIA BILITIES AND SHAREHOLDERS EQUITY $18,594

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Income Statement a For wholesale and retail customers Nike apparently recognizes revenues from the sale of products at the time of sale Nike recognizes wholesale revenues when title and the risks and ... View full answer

Get step-by-step solutions from verified subject matter experts