Foster Manufacturing is analyzing a capital investment project that is forecast to produce the following cash flows

Question:

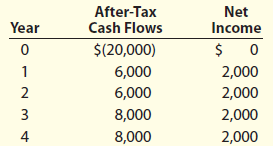

Foster Manufacturing is analyzing a capital investment project that is forecast to produce the following cash flows and net income:

The payback period of this project will be:

a. 2.5 years.

b. 2.6 years.

c. 3.0 years.

d. 3.3 years.

Payback PeriodPayback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Question Posted: