Sally owns a $1,000-par zero-coupon bond that has six years of remaining maturity. She plans on selling

Question:

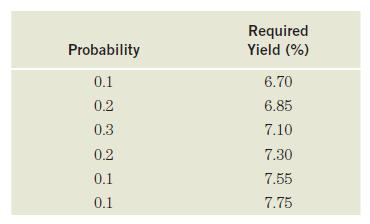

Sally owns a $1,000-par zero-coupon bond that has six years of remaining maturity. She plans on selling the bond in one year and believes that the required yield next year will have the following probability distribution:

a. What is the expected price of the bond at the time of sale?

b. What is the standard deviation of the bond price?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: