Consider a bond maturing in 18 months, paying semiannual coupons at rate (5 %), with face value

Question:

Consider a bond maturing in 18 months, paying semiannual coupons at rate \(5 \%\), with face value \(\$ 10,000\). The term structure is flat, so we identify interest rate \(r\) and yield \(y\), which is \(3 \%\) with continuous compounding. We assume that this rate is subject to an instantaneous shock, characterized by a normal distribution with \(\quad r=0 \%\) and \({ }_{r}=\) \(0.5 \%\), and we want to find V@R at confidence level \(99 \%\).

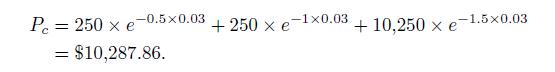

The current bond price is

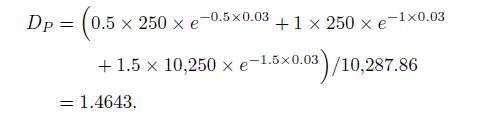

Its duration is

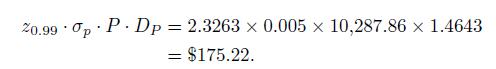

The approximated \(\mathrm{V} @ \mathrm{R}\) is given by

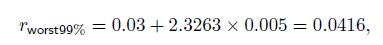

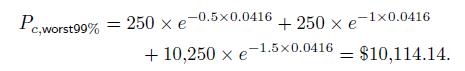

The exact \(\mathrm{V} @ \mathrm{R}\), in this simple case, can be found by just repricing the bond with the worst rate at \(99 \%\) confidence level,

which gives

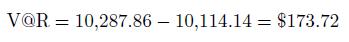

Hence, the exact value-at-risk is

which is fairly close to the approximation.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte