Let us consider a bond with face value ($ 10,000), maturing in three years, and paying an

Question:

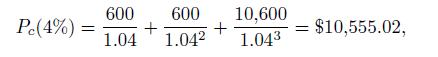

Let us consider a bond with face value \(\$ 10,000\), maturing in three years, and paying an annual coupon at rate \(6 \%\). If annual yield is \(4 \%\), the bond price is

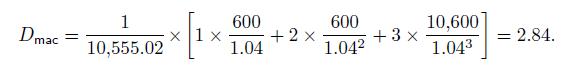

and its Macauley duration is

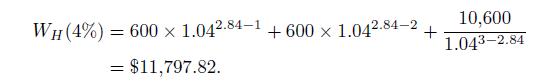

If yield does not change, we reinvest coupons at \(4 \%\), and sell the bond at time \(H=284\), wealth will be

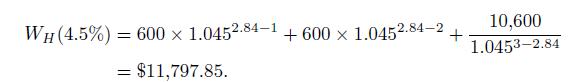

To understand this expression, note that the first two cash flows are reinvested up to time \(t=2.84\), whereas the third cash flow is discounted from time \(t=3\) to \(t=2.84\). If yield is increased by 50 basis points, wealth will be

Indeed, up to an approximation error, future wealth at the right time horizon is insensitive to small changes in yield.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: