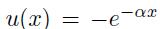

Question: Consider an exponential utility function , with a strictly positive . An investor characterised by this exponential utility has to allocate an initial wealth (W_{0})

Consider an exponential utility function  , with a strictly positive . An investor characterised by this exponential utility has to allocate an initial wealth \(W_{0}\) between a risk-free and a risky asset. We assume a binomial uncertainty model, so that the risky asset has two possible gains (not returns) \(R_{u}\) and \(R_{d}\), with probabilities \({ }_{u}\) and \({ }_{d}\), respectively. Let \(q\) be the wealth allocated to the risky asset; it is possible to borrow cash as well to short-sell the risky asset. How does \(q\) change as a function of initial wealth \(W_{0}\) ? Do you think that your utility function is exponential?

, with a strictly positive . An investor characterised by this exponential utility has to allocate an initial wealth \(W_{0}\) between a risk-free and a risky asset. We assume a binomial uncertainty model, so that the risky asset has two possible gains (not returns) \(R_{u}\) and \(R_{d}\), with probabilities \({ }_{u}\) and \({ }_{d}\), respectively. Let \(q\) be the wealth allocated to the risky asset; it is possible to borrow cash as well to short-sell the risky asset. How does \(q\) change as a function of initial wealth \(W_{0}\) ? Do you think that your utility function is exponential?

u(x) -ax = -e

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION To solve this problem we need to find the optimal allocation q that maximizes the expected ... View full answer

Get step-by-step solutions from verified subject matter experts