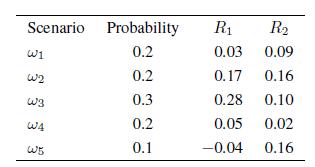

Consider assets (A_{1}) and (A_{2}), whose holding period returns (R_{1}) and (R_{2}), in five possible scenarios, are

Question:

Consider assets \(A_{1}\) and \(A_{2}\), whose holding period returns \(R_{1}\) and \(R_{2}\), in five possible scenarios, are given in the following table:

Note that the probabilities are not equal, and that returns are not given as a percentage (if you prefer, you might also write, e.g, \(R_{1}\left({ }_{1}\right)=3 \%\) ). Find the expected value and the standard deviation of the returns of the two assets, as well as their (Pearson) coefficient of correlation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: