Consider the following situation: - The price of a stock share is currently ($ 55). The stock

Question:

Consider the following situation:

- The price of a stock share is currently \(\$ 55\). The stock share will not pay any dividend in the next six months.

- Two options, a call and a put, are traded on that stock share, maturing in six months and with the same strike price, \(\$ 60\). The price of the call option is \(\$ 2\), and the price of the put is \(\$ 7\).

- The risk-free rate, with semiannual compounding, is currently \(4 \%\) (this means that by lending money for six months we gain \(2 \%\) of the capital.

Now, consider the following trade at time \(t=0\) :

- Write the put option to a counterparty (which will be the holder of the put option).

- Short the stock share.

- Buy the call option (we are the holders of the call option).

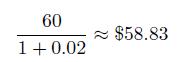

- Buy a riskless zero-coupon with face value, \(\$ 60\), which is equivalent to investing

for six months, at the risk-free rate.

Note that the overall cash flow at time \(t=0\) is

\[7+55 \quad 2 \quad 58.83=1.17\]

We are actually making some money, which is equivalent to saying that we have bought a portfolio with negative value.

At maturity, at time \(t=05\) measured in years, one of the following three cases will occur:

1. If the stock price is exactly \(\$ 60\) no option is exercised, and we use the face value of the bond to buy the stock share and close the short position.

2. If the stock price is larger than \(\$ 60\), the put is not exercised by its holder, and we use the call to buy the stock share at \(\$ 60\) and close the short position, where the cash needed is provided by the zero-coupon bond.

3. If the stock price is smaller than \(\$ 60\), the put is exercised by its holder: We have to buy the stock share at \(\$ 60\), and we use it to close the short position; again, the cash needed is provided by the zero. The call is not exercised.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte