It is interesting to compare the risk of a fixed- and a floating-rate bond. Let us consider

Question:

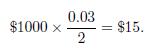

It is interesting to compare the risk of a fixed- and a floating-rate bond. Let us consider a bond with face value \(F=\$ 1000\), paying semiannual coupons, maturing at time \(T_{m}=4.75\) (four years and nine months), and let us assume that the term structure is flat and given by a semiannually compounded yield \(y_{2}=4 \%\). Given the time-to-maturity, the next reset date is \(T_{1}=0.25\), i.e., three months from now, and ten coupons will be paid over the bond life. Then, the coupon rate was reset three months ago, and let us assume that the observed rate was \(3 \%\). Hence, the next coupon amounts to

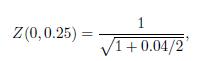

Note that the relevant discount factor, using the semiannual yield over 0.25 years, is

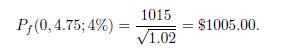

and so the price of the floater is

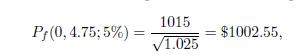

If the term structure is shifted up to \(5 \%\), the new bond price is

with a very limited loss:

It is easy to see that this loss would be the same for a bond maturing in 100 years! The reader is invited to compare these values with the corresponding ones for a fixed-coupon bond.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte