Let us consider a market on which three assets, indexed by (i=123), are traded, with current price

Question:

Let us consider a market on which three assets, indexed by \(i=123\), are traded, with current price

\[S_{1}(0)=S_{2}(0)=S_{3}(0)=1\]

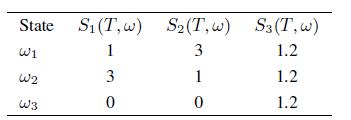

The asset values in the future, at time \(t=T\), depend on which state will be realized. We consider three possible scenarios ω1,ω2 , and ω3 , with probabilities \(55 \%, 30 \%\), and \(15 \%\), respectively. The corresponding asset values are given in the following table:

We note that asset 3 is risk-free, and that state ω3 is a "bad" state. Imagine an insurance contract against the occurrence of the bad state, whose payoff is 0 if states ω1 or ω2 occur, and 1 if state ω3 occurs. What is the fair price of this insurance contract? Do you need further information about risk aversion?

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte