Question: Let us consider the same setting as Example 13.4: (S_{0}=K=50), (r=01, quad=04), and time-to-maturity is (T=5/12) (here we take (t=0)). The calculation is as follows:

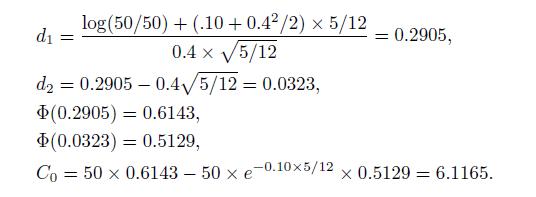

Let us consider the same setting as Example 13.4: \(S_{0}=K=50\), \(r=01, \quadó=04\), and time-to-maturity is \(T=5/12\) (here we take \(t=0)\). The calculation is as follows:

This exact result may be compared with the binomial approximation, which gave a price 6.36, which proves to be not too bad. It is important to realize that "exact" should be taken as relative to the BSM model.

d = log (50/50)+(.10 +0.42/2) x 5/12 0.4 x 5/12 d2 = 0.2905 0.4/5/12 = 0.0323, (0.2905)=0.6143, = 0.2905, (0.0323)=0.5129, Co= 50 x 0.6143 - 50 x e-0.10x5/12 x 0.5129 = 6.1165.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock