Let us consider a call option with maturity (T=1) year and strike price ($ 11). The current

Question:

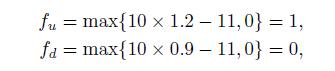

Let us consider a call option with maturity \(T=1\) year and strike price \(\$ 11\). The current price of the stock share is \(\$ 10\), and the riskfree interest rate is \(10 \%\). The two possible returns of the stock share in one year are either \(20 \%\) or \(-10 \%\), which implies \(u=12\) and \(d=0.9\). The corresponding payoffs in the up and down states are:

respectively. To find the replicating portfolio, we need the number of stock shares and the amount to invest in (or to borrow from)

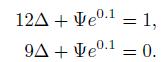

the bank account. To this aim, we have to solve the system of linear equations:

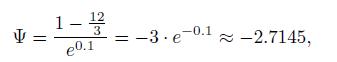

If we subtract the second equation from the first one, we get

![]()

Thus, for each call option, we should buy one third of a stock share. Plugging this value back into the first equation yields

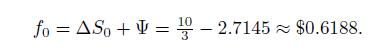

which means that the writer should borrow some cash. Note that the writer has to repay a debt that, at maturity, will amount to \(\$ 3\). By putting everything together, we obtain the fair option premium

This option premium and the additional borrowed cash are used to buy shares.

That, with a naked position, when the stock price goes up, the writer will have to buy one share at \(\$ 12\) just to hand it over to the option holder for \(\$ 11\), losing \(\$ 1\). With a covered position, if the price goes down and the option is not exercised, the writer loses \(\$ 1\) since she has to sell for \(\$ 9\) the share that was purchased for \(\$ 10\).

Let us check that, on the contrary, risk is hedged away if the writer buys \(=13\) shares. If the stock price goes down to \(\$ 9\), the option writer will just unwind the hedge and sell \(1 / 3\) shares for \(\$ 3\). This is just what the writer needs in order to repay debt at maturity. Hence, the option writer breaks even in the "down" scenario. In the "up" scenario, \(2 / 3\) additional shares are purchased at the unit price of \(\$ 12\), in order to sell a whole share to the option holder. The option writer breaks even again, as the \(\$ 11\) cashed in from the option exercise are exactly what she needs, \(\$ 8\) for the additional shares plus \(\$ 3\) to repay debt.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte