Repeat the analysis of Example 6.8, but now consider a bond maturing in five years. For the

Question:

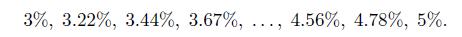

Repeat the analysis of Example 6.8, but now consider a bond maturing in five years. For the nonparallel shift, assume a new term structure of rates linearly increasing from \(3 \%\) to \(5 \%\), so that the average is \(4 \%\) in both cases, parallel and nonparallel shifts. In the second case, the rates for the ten maturities (six months, one year, one year and a half, all the way up to five years) are

Do you still observe a small loss as in Example 6.8? What if you increase the maturity of the zero to three or five years?

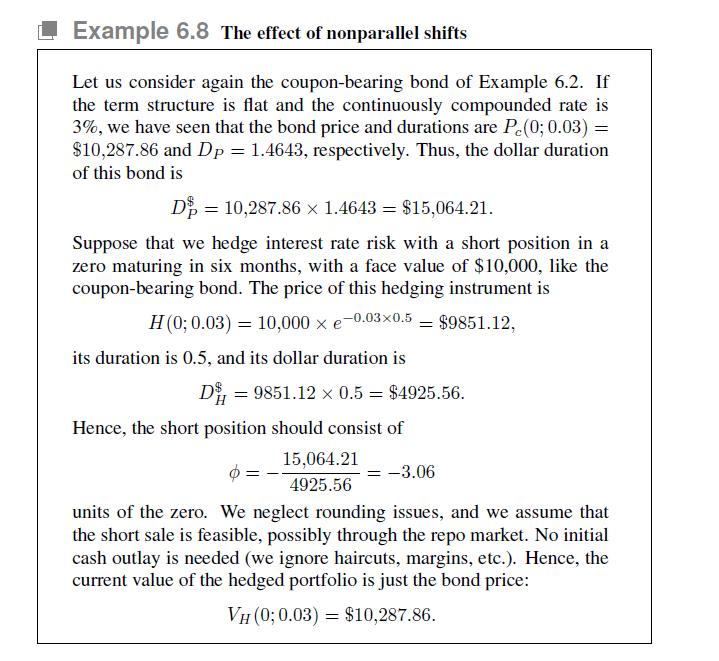

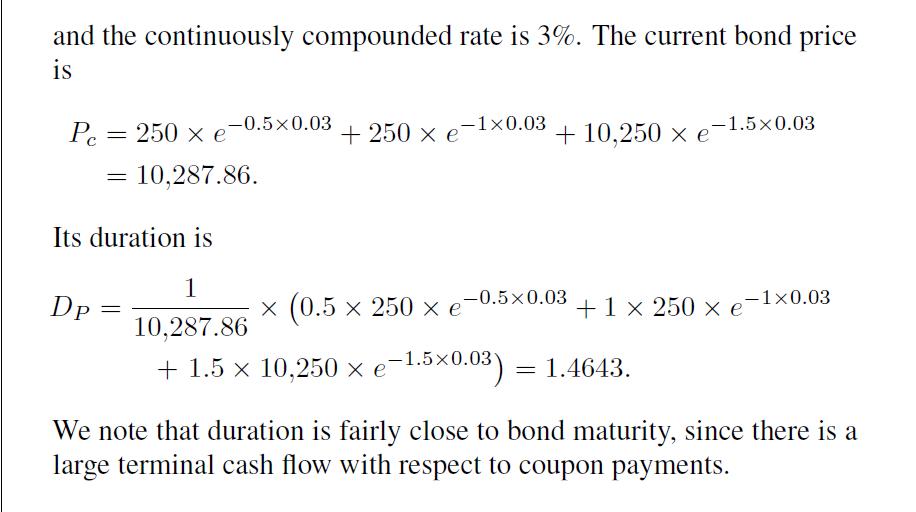

Data From Example 6.8

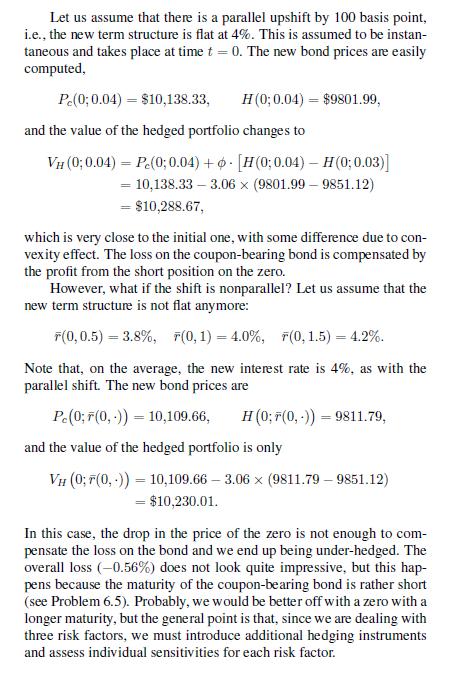

Data From Example 6.2

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: