The continuously compounded risk-free rates with maturities of 6,12 , 18 , and 24 months are, respectively,

Question:

The continuously compounded risk-free rates with maturities of 6,12 , 18 , and 24 months are, respectively, \(2.2 \%, 2.7 \%, 3.1 \%\), and \(3.49 \%\). A callable bond, with no default risk, following the usual market conditions, with coupon rate \(9 \%\), maturing in two years, trades for \(€ 101.12\) (face value is 100). What is the value of a call option on the corresponding noncallable bond?

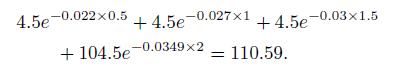

We notice that the bond has a large coupon rate, \(9 \%\), with respect to prevailing rates. Indeed, the bond sells at premium, but 101.12 does not seem large enough. Indeed, the price difference between a plain bond and a callable bond is just the value of the call (we assume that there is no default risk). The noncallable bond price is:

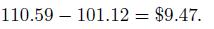

Then, the value of the call option is

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte