Let us consider a bond paying semiannual coupons with (6 %) coupon rate on a face value

Question:

Let us consider a bond paying semiannual coupons with \(6 \%\) coupon rate on a face value of \(\$ 1000\), which means that the bond pays \(\$ 30\)

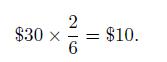

every six months. Let us ignore day count issues, for the sake of simplicity, and assume that the last coupon was paid two months ago. Accrued interest is obtained by prorating the next coupon as follows:

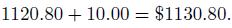

If yield is lower than the coupon rate, the bond shall trade at premium, say, at a quoted price of 112.08 . Thus, the cash price would be

Clean price + Accrued interest =

In practice, this calculation should be carried out according to the relevant day count convention pertaining to the specific bond at hand.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: