The current price of a stock share that pays no dividend is ( 50). The price follows

Question:

The current price of a stock share that pays no dividend is \(€ 50\). The price follows a GBM with drift \(12 \%\) and volatility \(35 \%\); the continuously compounded risk-free rate is \(5 \%\). Consider a call and a put options, both European-style, with strike \(€ 55\), maturing in nine months. Which option is more likely to be exercised?

The probability of exercising the call is ), which is given by

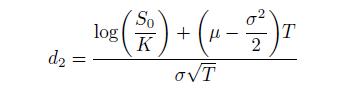

), which is given by  , provided that we use the true drift. Hence, we should compute

, provided that we use the true drift. Hence, we should compute  as

as

Since , there is no need for further calculations, as this implies

, there is no need for further calculations, as this implies  . Hence, the put is more likely to be exercised.

. Hence, the put is more likely to be exercised.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: