The current price of an asset is (S_{0}=$ 100), and we have a strong belief that it

Question:

The current price of an asset is \(S_{0}=\$ 100\), and we have a strong belief that it will rise in the near future. One possible strategy is simply to buy the asset. If we are right and, say, the asset price at some later time \(T\) turns out to be \(S_{T}=\$ 120\), the holding period return is

\[\frac{120 \quad 100}{100}=20 \%\]

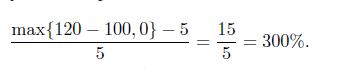

Now let us assume that a call option with strike price \(K=\$ 100\) costs \(\$ 5\). If we buy the call option, the return in the above scenario is a stellar

Clearly, there must be some other side of the coin. To get a feeling, let us assume that we are wrong and the underlying asset price goes down by \(1 \%\). The percentage loss, if we invest in the asset itself, will be a not too painful 1\%: We may be fairly disappointed, but this is a loss we may well live with. However, the call option return is

\[\frac{\max 99 \quad 1000 \quad 5}{5}=\frac{5}{5}=100 \%\]

since the option expires worthless and we lose the whole premium.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte