Question: Based on Exhibit 2, the job candidate most likely using a bottom-up approach to model net sales is: A. Candidate A B. Candidate B C.

Based on Exhibit 2, the job candidate most likely using a bottom-up approach to model net sales is:

A. Candidate A B. Candidate B C. Candidate C Angela Green, an investment manager at Horizon Investments, intends to hire a new investment analyst. After conducting initial interviews, Green has narrowed the pool to three candidates. She plans to conduct second interviews to further assess the candidates’

knowledge of industry and company analysis.

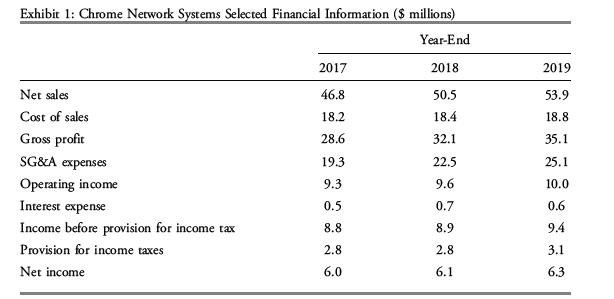

Prior to the second interviews, Green asks the candidates to analyze Chrome Network Systems, a company that manufactures internet networking products. Each candidate is provided Chrome’s financial information presented in Exhibit 1.

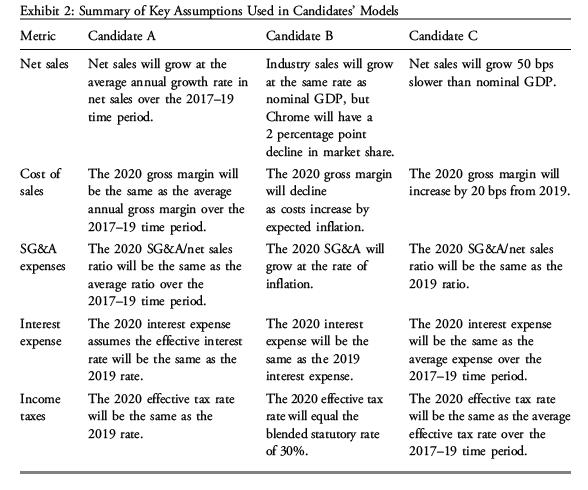

Green asks each candidate to forecast the 2020 income statement for Chrome and to outline the key assumptions used in their analysis. The job candidates are told to include Horizon’s economic outlook for 2020 in their analysis, which assumes nominal GDP growth of 3.6%, based on expectations of real GDP growth of 1.6% and inflation of 2.0%.

Green receives the models from each of the candidates and schedules second interviews. To prepare for the interviews, Green compiles a summary of the candidates’ key assumptions inExhibit 2.

Exhibit 1: Chrome Network Systems Selected Financial Information ($ millions) Year-End 2017 2018 2019 Net sales Cost of sales 46.8 50.5 53.9 18.2 18.4 18.8. Gross profit 28.6 32.1 35.1 SG&A expenses 19.3 22.5 25.1 Operating income 9.3 9.6 10.0 Interest expense 0.5 0.7 0.6 Income before provision for income tax 8.8. 8.9 9.4 Provision for income taxes 2.8 2.8 3.1 Net income 6.0 6.1 6.3

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

A is correct A bottomup approach for developing inputs to equity valuatio... View full answer

Get step-by-step solutions from verified subject matter experts