Question: In this exercise we solve iteratively for the internal rate of return. Consider an investment that costs 800 and has cash flows of 300, 200,

In this exercise we solve iteratively for the internal rate of return. Consider an investment that costs 800 and has cash flows of 300, 200, 150, 122, and 133 in years 1 to 5.

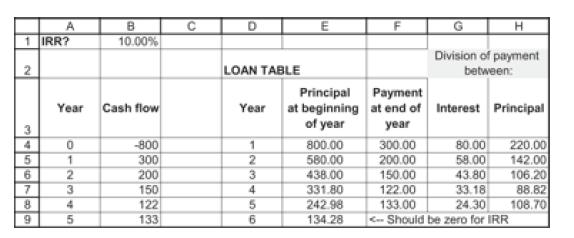

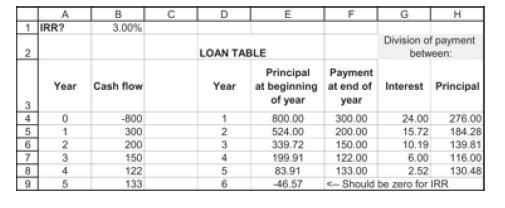

Setting up the loan amortization table below shows that 10% is greater than the IRR (since the return of principal at the end of year 5 is less than the principal at the beginning of the year). Setting cell B1 to 3% shows that 3% is less than the IRR, since the return of principal at the end of year 5 is greater than the principal at the beginning of year 5.

Setting cell B1 to 3% shows that 3% is less than the IRR, since the return of principal at the end of year 5 is greater than the principal at the beginning of year 5.

By changing the IRR in cell B1, find the internal rate of return of the investment.

1 IRR? A B C 10.00% E H 2 LOAN TABLE Division of payment between: Principal Payment Year Cash flow Year at beginning at end of Interest Principal of year year 3 4 0 -800 1 800.00 300.00 80.00 220.00 5 1 300 2 580.00 200.00 58.00 142.00 6 2 200 3 438.00 150.00 43.80 106.20 7 3 150 4 331.80 122.00 33.18 88.82 8 4 122 5 242.98 133.00 24.30 108.70 9 5 133 6 134.28

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts