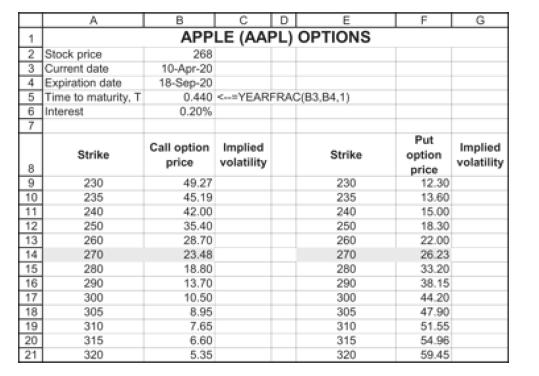

Question: The table below gives prices for Apple (AAPL) options on April 10, 2020. The option with exercise price X = $270 is assumed to be

The table below gives prices for Apple (AAPL) options on April 10, 2020. The option with exercise price X = $270 is assumed to be the at-the-money option.

a. Compute the implied volatility of each option (use the functions CallVolatility and PutVolatility defined in the chapter or the equivalent R code).

b. Graph these volatilities. Is there a volatility “smile”?

1 A B C D E F APPLE (AAPL) OPTIONS 268 2 Stock price 3 Current date 10-Apr-20 4 Expiration date 18-Sep-20 5 Time to maturity, T 6 Interest 7 0.440

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock