Bryan Trucking Corporation began business on January 1, 20X1, and consists of the parent entity, domiciled and

Question:

Bryan Trucking Corporation began business on January 1, 20X1, and consists of the parent entity, domiciled and operating in Country X, and a subsidiary operating in Country Y. Bryan is required, as a listed company in Country X, to prepare financial statements using IFRS. Bryan is also listed on the New York Stock Exchange (NYSE). Therefore, Bryan is registered as a “foreign private issuer” with the U.S. Securities and Exchange Commission and must file financial statements with the SEC in accordance with SEC regulations for foreign private issuers. These regulations permit Bryan to file its IFRS financial statements with the SEC, but it has decided to prepare U.S. GAAP financial statements as well for the convenience of its U.S. shareholders.

With respect to the reconciliation of the statutory tax rate to the effective tax rate in the income tax note disclosure, SEC regulations for foreign private issuers permit them to reconcile to either the relevant statutory income tax rate in their country of domicile or to another applicable tax rate. Reconciling to the statutory income tax rate in its country of domicile would be comparable to a U.S. company reconciling to the U.S. federal tax rate.

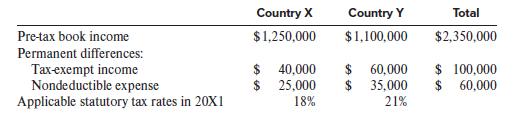

Bryan carefully selected its accounting policies under IFRS and U.S. GAAP so that, in 20X1, it reported the same pre-tax book income in both the U.S. GAAP and IFRS financial statements. Therefore, the only difference between the tax rate reconciliation in the U.S. GAAP financial statements and the IFRS financial statements is due to the use of a country-specific statutory tax rate (statutory tax rate in Country X) or a weighted-average statutory tax rate (another applicable tax rate) as the beginning point of the reconciliation. The table below presents Bryan’s pre-tax book income and the applicable statutory tax rates in each country and permanent differences between taxable and book income in the two countries in which Bryan operates. Bryan has no temporary differences in 20X1.

Required:

Prepare the portion of the income tax note that details the reconciliation of the statutory or other applicable tax rate to the effective tax rate as follows:

1. Assume Bryan uses the statutory tax rate in Country X for the tax rate reconciliation in its U.S. GAAP financial statements.

2. Assume Bryan uses a weighted-average statutory rate for the tax rate reconciliation in its IFRS financial statements.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer