Kent, Incs reconciliation between financial statement and taxable income for 2008 follows: The enacted tax rate was

Question:

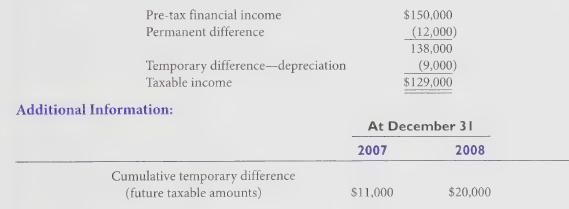

Kent, Inc’s reconciliation between financial statement and taxable income for 2008 follows:

The enacted tax rate was 35% for 2007 and 40% for 2008 and years thereafter.

Required:

1. In its December 31, 2008 balance sheet, what amount should Kent report as its deferred income tax liability?

2. In its 2008 income statement, what amount should Kent report as the current portion of income tax expense?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: