Question:

Margaret O’Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in 10 years. She asks you to analyze the company to determine the riskiness of the bonds.

Required:

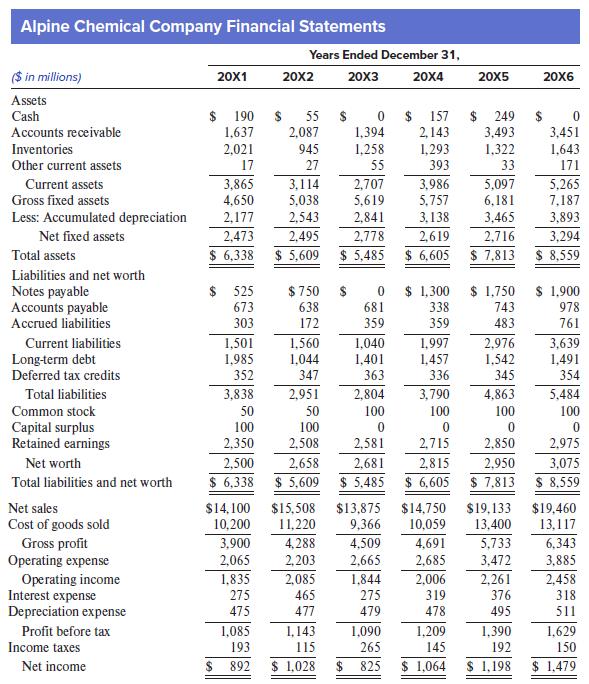

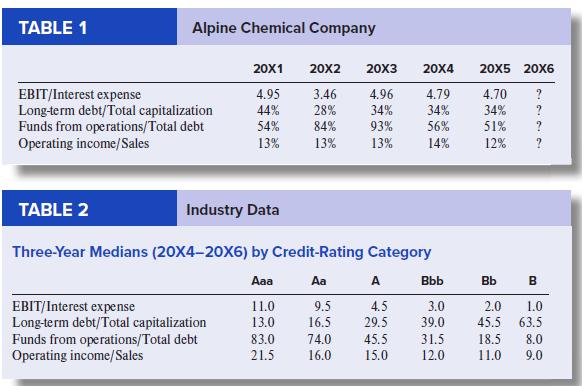

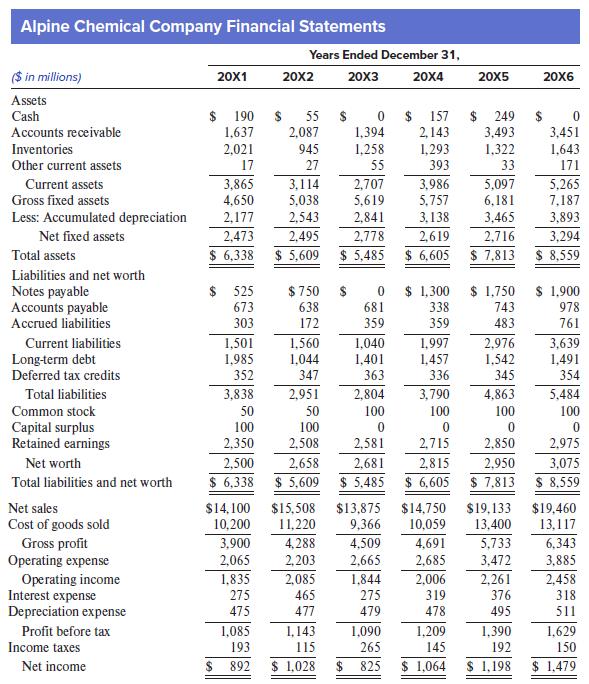

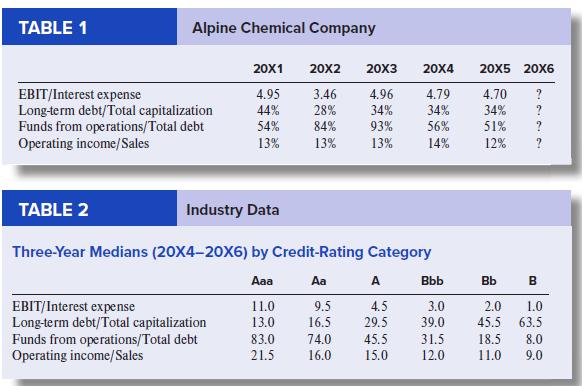

1. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 20X6:

a. EBIT/Interest expense

b. Long-term debt/Total capitalization at December 31

c. Funds from operations/Total debt

d. Operating income/Sales

Use the following conventions: EBIT is earnings before interest and taxes; Total capitalization is interest-bearing long-term debt plus net worth; Funds from operations means net income plus depreciation expense; and Total debt includes interest-bearing short-term and long-term debt.

2. Briefly explain the significance of each ratio calculated in requirement 1 to the assessment of Alpine Chemical’s creditworthiness.

3. Insert your answers to requirement 1 into Table 1 that follows. Then, from Table 2, select an appropriate credit rating for Alpine Chemical.

Transcribed Image Text:

Alpine Chemical Company Financial Statements Years Ended December 31, ($ in millions) 20X1 20X2 20х3 20X4 20X5 20X6 Assets $ 190 $ 1,637 2,087 0 $ 157 1,394 1,258 Cash 55 249 $ 3,451 Accounts receivable 2,143 3,493 945 27 Inventories 2,021 1,322 1,293 393 1,643 Other current assets 17 55 33 171 Current assets 3,865 3,114 2,707 3,986 5,757 5,097 6,181 5,265 7,187 Gross fixed assets 4,650 5,038 5,619 Less: Accumulated depreciation 2,177 2,543 2,841 3,138 3,465 3,893 Net fixed assets 2,473 2,495 2,778 2,619 2,716 3,294 Total assets $ 6,338 $ 5,609 $ 5,485 $ 6,605 $ 7,813 $ 8,559 Liabilities and net worth $ 525 $ 750 $ 1,300 338 $ 1,750 $ 1,900 Notes payable Accounts payable Accrued liabilities 673 638 681 743 978 303 172 359 359 483 761 1,040 1,401 363 1,997 1,457 336 3,639 1,491 Current liabilities 1,501 1,560 2,976 1,542 Long-term debt Deferred tax credits 1,985 1,044 352 347 345 354 Total liabilities 3,838 2,951 2,804 3,790 4,863 5,484 Common stock 50 50 100 100 100 100 Capital surplus Retained earnings 100 100 2,350 2,508 2,581 2,715 2,850 2,975 Net worth 2,500 2,658 2,681 2,815 2,950 3,075 Total liabilities and net worth $ 6,338 $ 5,609 $ 5,485 $ 6,605 $ 7,813 $ 8,559 Net sales $14,100 10,200 $15,508 11,220 $13,875 9,366 $14,750 10,059 $19,133 13,400 $19,460 Cost of goods sold 13,117 3,900 4,288 4,509 Gross profit Operating expense Operating income Interest expense Depreciation expense 4,691 5,733 6,343 2,065 2,203 2,665 2,685 3,472 3,885 1,835 2,006 2,085 465 1,844 2,261 2,458 318 275 275 319 376 475 477 479 478 495 511 Profit before tax 1,085 1,143 1,090 1,209 1,390 1,629 Income taxes 193 115 265 145 192 150 Net income $ 892 $ 1,028 2$ 825 $ 1,064 $ 1,198 $ 1,479