On January 1, 20X1, Pluto Company acquired all of Saturn Companys common stock for $1,000,000 cash. On

Question:

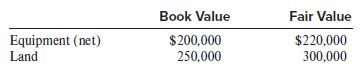

On January 1, 20X1, Pluto Company acquired all of Saturn Company’s common stock for $1,000,000 cash. On that date, Saturn had retained earnings of $200,000 and common stock of $600,000. The book values of Saturn’s assets and liabilities were equal to fair values except for the following:

Additional Information:

a. The equipment had an estimated remaining useful life of five years at acquisition.

b. Goodwill was not impaired at December 31, 20X1, but was impaired by $25,000 at December 31, 20X2.

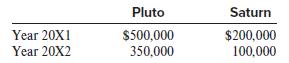

c. Reported income for Pluto (excluding equity income from Saturn’s earnings) and Saturn follows:

Required:

1. Prepare the January 1, 20X1, journal entry on Pluto’s books to record the acquisition of Saturn.

2. Prepare the elimination entries needed to prepare a consolidated balance sheet immediately after acquisition.

3. Calculate consolidated income for 20X1 and 20X2.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer