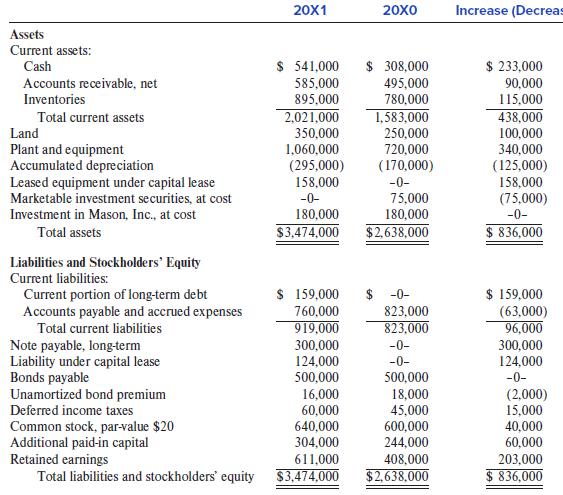

Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 20X1 and 20X0.

Question:

Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 20X1 and 20X0.

Additional Information:

• On January 2, 20X1, Bergen sold all of its marketable investment securities for $95,000 cash.

• On March 10, 20X1, Bergen paid a cash dividend of $50,000 on its common stock. No other dividends were paid or declared during 20X1.

• On April 15, 20X1, Bergen issued 2,000 shares of its common stock for land having a fair value of $100,000.

• On May 25, 20X1, Bergen borrowed $450,000 from an insurance company. The underlying promissory note bears interest at 15% and is payable in three equal annual installments of $150,000. The first payment is due on May 25, 20X2.

• On June 15, 20X1, Bergen purchased equipment for $392,000 cash.

• On July 1, 20X1, Bergen sold equipment costing $52,000, with a book value of $28,000, for $33,000 cash.

• On December 31, 20X1, Bergen leased equipment from Tilden Company for a 10-year period. Equal payments under the lease are $25,000 due on December 31 each year.

The first payment was made on December 31, 20X1. The present value at December 31, 20X1, of the 10 lease payments is $158,000. Bergen appropriately recorded the lease as a finance lease. The $25,000 lease payment due on December 31, 20X2, will consist of $9,000 principal and $16,000 interest.

• Bergen’s net income for 20X1 is $253,000.

• Bergen owns a 10% interest in the voting common stock of Mason, Inc. Mason reported net income of $120,000 for the year ended December 31, 20X1, and paid a common stock dividend of $55,000 during 20X1.

Required:

Prepare a cash flow statement for Bergen using the indirect method for 20X1.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer