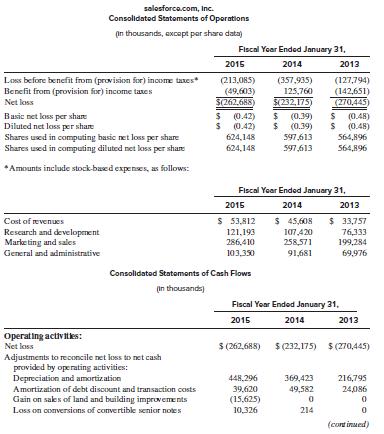

Question: Refer to the salesforce.com financial statement excerpts given below to answer the questions. On January 31, 2015, the price of salesforce.com stock was $56.45, and

Refer to the salesforce.com financial statement excerpts given below to answer the questions. On January 31, 2015, the price of salesforce.com stock was $56.45, and there were 650,596,000 shares of common stock outstanding. All questions relate to the year ended January 31, 2015, unless stated otherwise.

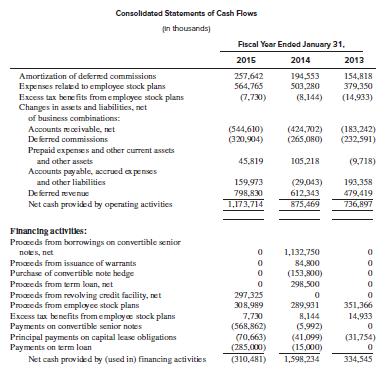

Notes to Consolidated Financial Statements

1. Summary of Business and Significant Accounting Policies

Description of Business

Salesforce.com, inc. (the “Company”) is a leading provider of enterprise cloud computing services. The Company is dedicated to helping customers of all sizes and industries worldwide transform themselves into “customer companies” by empowering them to connect with their customers, partners, employees and products in entirely new ways. The Company provides customers with the solutions they need to build a next generation social front office with social and mobile cloud technologies.

Accounting for Stock-Based Expense

The Company recognizes stock-based expenses related to stock options and restricted stock awards on a straight-line basis over the requisite service period of the awards, which is generally the vesting term of four years. The Company recognizes stock-based expenses related to shares issued pursuant to its 2004 Employee Stock Purchase Plan (“ESPP”) on a straight-line basis over the offering period, which is 12 months. Stock-based expenses are recognized net of estimated forfeiture activity. The estimated forfeiture rate applied is based on historical forfeiture rates. The Company does not anticipate paying any cash dividends in the foreseeable future and therefore uses an expected dividend yield of zero in the option pricing model.

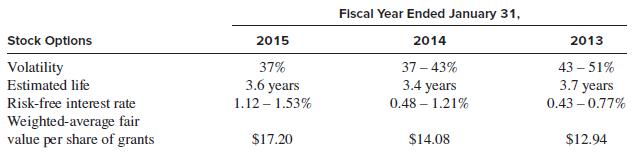

The fair value of each stock option grant was estimated on the date of grant using the Black Scholes option pricing model with the following assumptions and fair value per share:

The Company estimated its future stock price volatility considering both its observed option implied volatilities and its historical volatility calculations. Management believes this is the best estimate of the expected volatility over the expected life of its stock options and stock purchase rights.

The estimated life for the stock options was based on an analysis of historical exercise activity. The estimated life of the ESPP was based on the two purchase periods within each offering period. The risk-free interest rate is based on the rate for a U.S. government security with the same estimated life at the time of the option grant and the stock purchase rights.

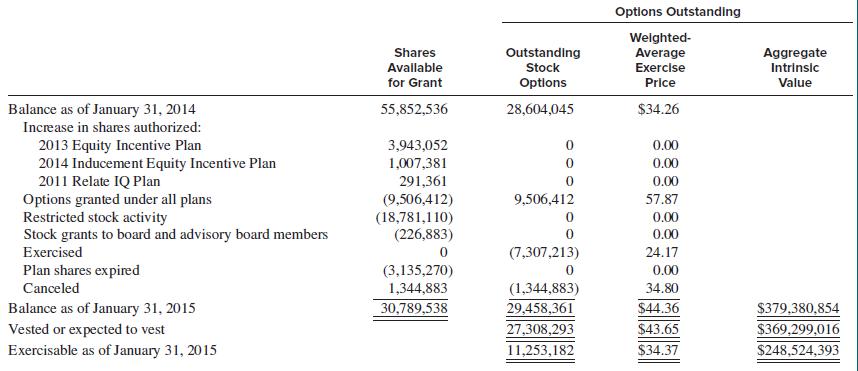

7. Stockholders’ Equity

The Company maintains the following stock plans: the ESPP, the 2013 Equity Incentive Plan and the 2014 Inducement Equity Incentive Plan (the “2014 Inducement Plan”). The expiration of the 1999 Stock Option Plan (“1999 Plan”) in fiscal 2010 did not affect awards outstanding, which continue to be governed by the terms and conditions of the 1999 Plan.

On July 10, 2014, the Company adopted the 2014 Inducement Plan with a reserve of 335,000 shares of common stock for future issuance solely for the granting of inducement stock options and equity awards to new employees, including employees of acquired companies. In addition, approximately 319,000 shares of common stock that remained available for grant under the 2006 Inducement Equity Incentive Plan (the “Prior Inducement Plan”) as of July 9, 2014, were added to the 2014 Inducement Plan share reserve and the Prior Inducement Plan was terminated. Further, any shares of common stock subject to outstanding awards under the Prior Inducement Plan that expire, are forfeited, or are repurchased by the Company will also become available for future grant under the 2014 Inducement Plan. Termination of the Prior Inducement Plan did not affect the outstanding awards previously issued thereunder. The 2014 Inducement Plan was adopted without stockholder approval in reliance on the “employment inducement exemption” provided under the New York Stock Exchange Listed Company Manual.

In September 2011, the Company’s Board of Directors amended and restated the ESPP. In conjunction with the amendment of the ESPP, the Company’s Board of Directors determined that the offerings under the ESPP would commence, beginning with a twelve month offering period starting in December 2011. As of January 31, 2015, $28.7 million has been withheld on behalf of employees for future purchases under the ESPP and is recorded in accounts payable, accrued expenses and other liabilities. Employees purchased 3.3 million shares for $127.8 million and 2.9 million shares for $92.5 million, in fiscal 2015 and 2014, respectively, under the ESPP.

Prior to February 1, 2006, options issued under the Company’s stock option plans generally had a term of 10 years. From February 1, 2006, through July 3, 2013, options issued had a term of five years. After July 3, 2013, options issued have a term of seven years.

Stock activity excluding the ESPP is as follows:

The total intrinsic value of the options exercised during fiscal 2015, 2014, and 2013 was $250.3 million, $292.3 million, and $506.9 million, respectively. The intrinsic value is the difference between the current market value of the stock and the exercise price of the stock option.

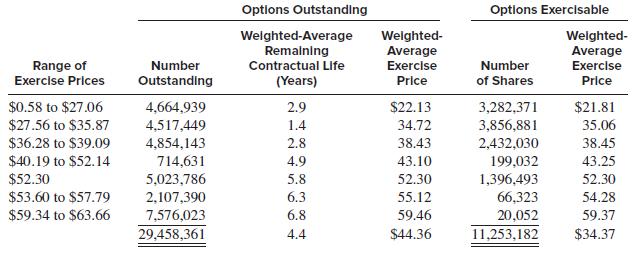

The weighted-average remaining contractual life of vested and expected to vest options is approximately 4.3 years.

As of January 31, 2015, options to purchase 11,253,182 shares were vested at a weighted average exercise price of $34.37 per share and had a remaining weighted-average contractual life of approximately 2.5 years. The total intrinsic value of these vested options as of January 31, 2015, was $248.5 million.

The following table summarizes information about stock options outstanding as of January 31, 2015:

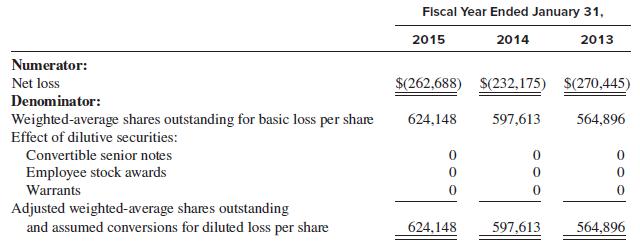

9. Earnings/Loss Per Share

Basic earnings/loss per share is computed by dividing net income (loss) by the weighted-average number of common shares outstanding for the fiscal period. Diluted earnings/loss per share is computed by giving effect to all potential weighted average dilutive common stock, including options, restricted stock units, warrants and the convertible senior notes. The dilutive effect of outstanding awards and convertible securities is reflected in diluted earnings per share by application of the treasury stock method. Diluted loss per share for fiscal 2015, 2014, and 2013 are the same as basic loss per share as there is a net loss in these periods and inclusion of potentially issuable shares is anti-dilutive.

A reconciliation of the denominator used in the calculation of basic and diluted loss per share is as follows (in thousands):

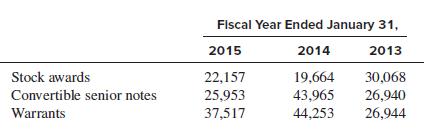

The weighted-average number of shares outstanding used in the computation of basic and diluted earnings/loss per share does not include the effect of the following potential outstanding common stock. The effects of these potentially outstanding shares were not included in the calculation of diluted earnings/loss per share because the effect would have been anti-dilutive (in thousands):

Required:

1. What amount of stock-based compensation expense did salesforce.com recognize in 2015 Where is this expense reported in the income statement?

2. What are the main reasons that its Net loss is $(262,688), but its Net cash provided by operating activities is $1,173,714?

3. What is the amount of total compensation cost for the stock options granted by salesforce. com during fiscal 2015? Why is this amount not equal to the compensation expense from requirement 1?

4. Fiscal year 2015 stock options are valued at $17.20. Use an option pricing calculator to verify this calculation. Assume that the exercise price at date of grant equals the stock price at date of grant.

5. In 2015, the company changed its estimated life from 3.4 years to 3.6 years. Explain how this change affected the estimated fair value of its options.

6. Note 7 states that the Aggregate intrinsic value of exercisable options is $248,524,393. Show how salesforce.com would have computed this amount. What is the difference in meaning between exercisable and outstanding? Compute the ratio of Aggregate intrinsic value of outstanding options to the market value of common stock.

7. Were the actual tax benefits received by salesforce.com from the exercise of stock options in 2015 higher or lower than the Deferred income tax asset that had been established previously Explain.

8. Explain how salesforce.com’s tax expense will change when it transitions to ASU 2016-09. Be as specific as possible.

9. Note 9 shows that stock awards should have increased the diluted EPS denominator by 22,157 shares in 2015. Explain why they were not included in the calculation of diluted EPS.

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Based on the provided financial statement excerpts from salesforcecom for the fiscal year ended January 31 2015 lets answer each of the questions in turn 1 The amount of stockbased compensation expens... View full answer

Get step-by-step solutions from verified subject matter experts