The following is an excerpt from the 2018 Form 10-K of Walgreens Boots Alliance, Inc. (Walgreens). It

Question:

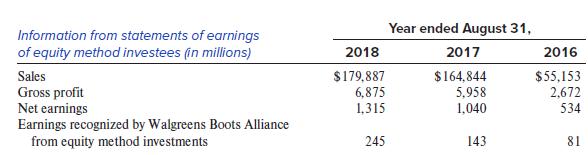

The following is an excerpt from the 2018 Form 10-K of Walgreens Boots Alliance, Inc. (Walgreens). It provides summary income statement data about the companies in which Walgreens has an equity method investment, as well as showing the amount of equity method income recognized by Walgreens.

Suppose that when determining the amount of equity method income to recognize in the year ended August 31, 2018 (fiscal 2018), Walgreens determined that $60 million of excess cost should be amortized in that year.

Required:

Estimate the percentage ownership Walgreens has in its equity method investments.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Question Posted: