Assume that the hypothetical Blake Co. acquires 30% of the outstanding shares of the hypothetical Brown Co.

Question:

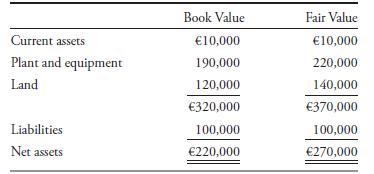

Assume that the hypothetical Blake Co. acquires 30% of the outstanding shares of the hypothetical Brown Co. At the acquisition date, book values and fair values of Brown’s recorded assets and liabilities are as follows:

Blake Co. believes the value of Brown Co. is higher than the fair value of its identifiable net assets. They offer €100,000 for a 30% interest in Brown, which represents a 34,000 excess purchase price. The difference between the fair value and book value of the net identifiable assets is €50,000 (€370,000 – 320,000). Based on Blake Co.’s 30% ownership, €15,000 of the excess purchase price is attributable to the net identifiable assets, and the residual is attributable to goodwill. Calculate goodwill.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie