Car manufacturers Audi, BMW Group, and Skoda Auto spend considerable amounts on research and development and capitalize

Question:

Car manufacturers Audi, BMW Group, and Skoda Auto spend considerable amounts on research and development and capitalize a proportion of these amounts each year. Each manufacturer systematically amortizes development cost assets, presumably using the straight-line method, following the start of the production of a developed car model or component.

In the notes to their financial statements, the firms report the following (average) estimated product lives:

● Audi: Four to nine years.

● BMW: Usually five to twelve years.

● Skoda: One to nine years, according to the product life cycle.

In 2017, the proportion of capitalized development expenditures that concerned costs for products under development (i.e., models or components that are not yet in production) was 36 percent for Audi and 34 percent for Skoda (BMW did not disclose this proportion).

Audi and BMW both focus their activities on the premium sector of the automobile market. Skoda operates primarily in the lower segments of the market. Both Audi and Skoda are majority owned by Volkswagen Group and share car platforms and production facilities with their major shareholder.

BMW is publicly listed and independent (from other car manufacturers).

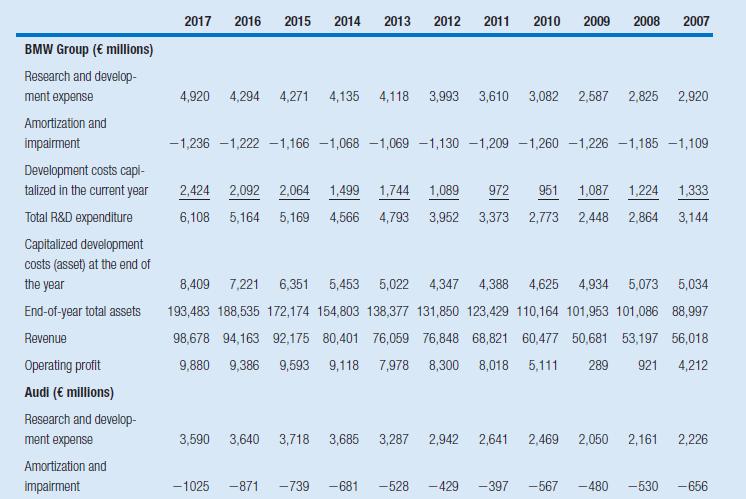

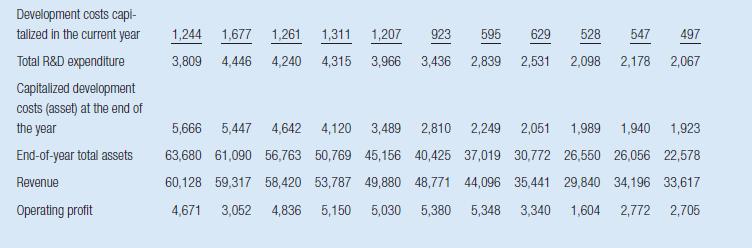

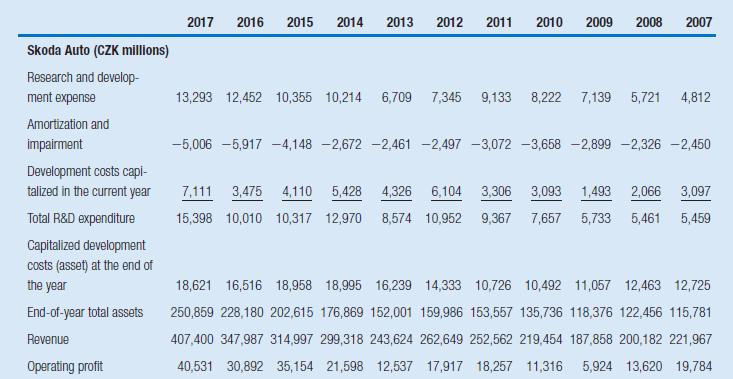

The following table displays the firms’ research and development expenditures and the amount capitalized and amortized during the years 2007–2017.

1 Estimate the average economic lives of the car manufacturers’ development assets. What assumptions make your estimates of the average economic lives consistent with those reported by the manufacturers?

2 The percentages of R&D expenditures capitalized fluctuate over time and differ between car manufacturers. Which factors may explain these fluctuations and differences? As an analyst, what questions would you raise with the CFO about the levels of and fluctuations in these capitalization percentages?

3 In accordance with IAS 38, the three car manufacturers do not capitalize research expenditures.

From an analyst’s perspective, which arguments would support capitalization (rather than immediate expensing) of research expenditures?

4 What adjustments to the car manufacturers’ 2017 financial statements are required if you decide to capitalize (and gradually amortize) the firms’ entire R&D? Which of the three manufacturers is most affected by these adjustments?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu