Hennes & Mauritz (H&M) and Inditex are publicly listed apparel retailers. The following information is taken from

Question:

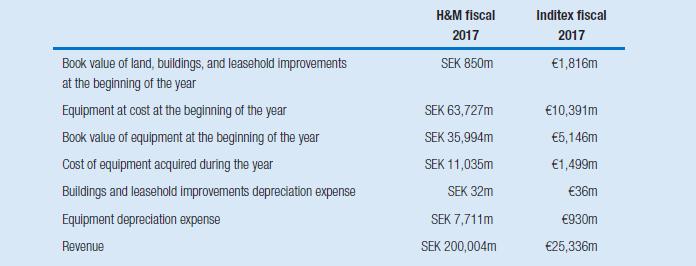

Hennes & Mauritz (H&M) and Inditex are publicly listed apparel retailers. The following information is taken from their financial statements for the fiscal years ending on November 30, 2017, and January 31, 2018, respectively (hereafter referred to as fiscal 2017):

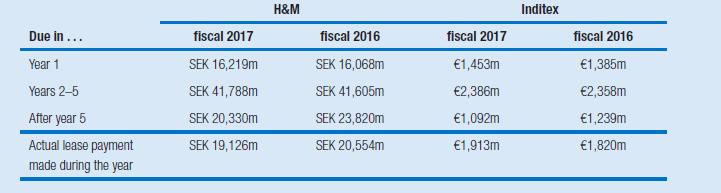

Both retailers had non-cancelable operating leases related to land, buildings, and equipment. Under the operating lease agreements, the companies were committed to paying the following amounts:

The statutory tax rates of H&M and Inditex were 22 and 25 percent, respectively. Assume that in 2017 the incremental borrowing rate of H&M and Inditex was 3 percent and that all land, buildings, and equipment had zero residual values. Further assume that both retailers recognized half a year of depreciation on assets acquired during the year.

1 Two measures of the efficiency of a firm’s investment policy are

(a) the ratio of land, buildings, leasehold improvements, and equipment to revenue and

(b) the ratio of depreciation to revenue. Calculate both ratios for H&M and Inditex based on the reported information. Which of the two companies appears to be relatively more efficient in its investment policy?

2 Calculate the depreciation rates that H&M and Inditex use for their equipment.

3 What adjustments to

(a) the beginning book value of H&M’s equipment and

(b) the equipment depreciation expense would be required if you assume that H&M uses Inditex’s depreciation rate?

4 What adjustments to

(a) the beginning book value of H&M’s and Inditex’s land, buildings, and equipment and

(b) H&M’s and Inditex’s depreciation expense would be required if you capitalize the retailers’ operating leases?

5 Recalculate the investment efficiency measures using the adjusted data. Do the adjustments affect your assessment of the retailers’ investment efficiency?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu