CEC Entertainment, Inc. (NYSE: CEC) has significant commitments under capital (finance) and operating leases. Following is selected

Question:

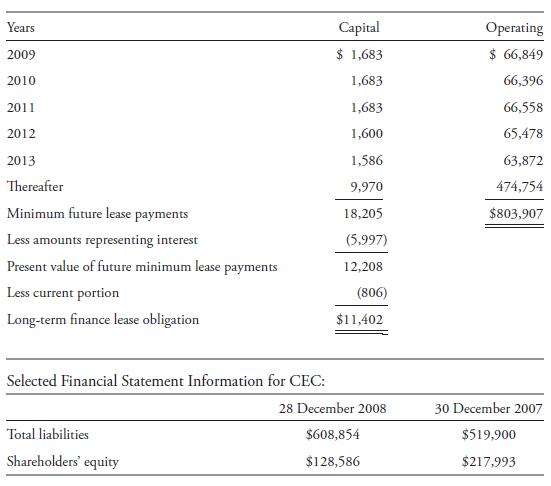

CEC Entertainment, Inc. (NYSE: CEC) has significant commitments under capital (finance) and operating leases. Following is selected financial statement information and note disclosure to the financial statements for the company.

Commitments and Contingencies Footnote from CEC’s Financial Statements:

8. Commitments and contingencies:

The company leases certain restaurants and related property and equipment under operating and capital leases. All leases require the company to pay property taxes, insurance, and maintenance of the leased assets. The leases generally have initial terms of 10 to 20 years with various renewal options.

Scheduled annual maturities of the obligations for capital and operating leases as of 28 December 2008 are as follows (US$ thousands):

1.

A. Calculate the implicit interest rate used to discount the “scheduled annual maturities”

under capital leases to obtain the “present value of future minimum lease payments” of $12,208 disclosed in the Commitments and Contingencies footnote. To simplify the calculation, assume that future minimum lease payments on the company’s capital leases for the “thereafter” lump sum are as follows: $1,586 on 31 December of each year from 2014 to 2019, and $454 in 2020. Assume annual lease payments are made at the end of each year.

B. Why is the implicit interest rate estimate in Part A important in assessing a company’s leases?

2. If the operating lease agreements had been treated as capital leases, what additional amount would be reported as a lease obligation on the balance sheet at 28 December 2008? To simplify the calculation, assume that future minimum lease payments on the company’s operating leases for the “thereafter” lump sum are as follows: $63,872 on 31 December each year from 2014 to 2020, and $27,650 in 2021. Based on the implicit interest rate obtained in Part 1A, use 7.245 percent to discount future cash flows on the operating leases.

3. What would be the effect on the debt-to-equity ratio of treating all operating leases as finance leases (i.e., the ratio of total liabilities to equity) at 28 December 2008?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie