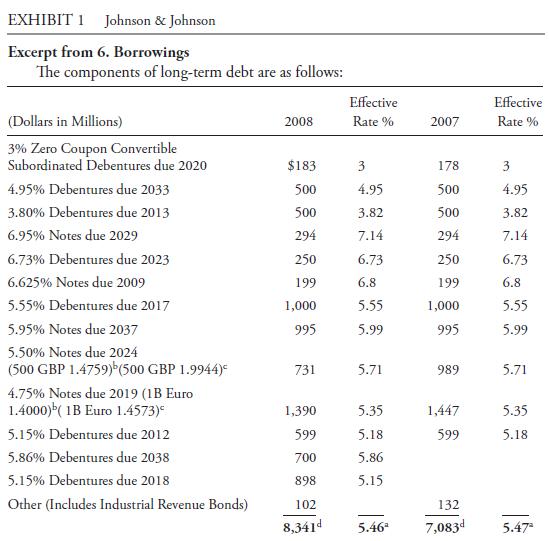

Exhibit 1 is an excerpt from Note 6 of Johnson & Johnsons (NYSE: JNJ) 2008 financial statements

Question:

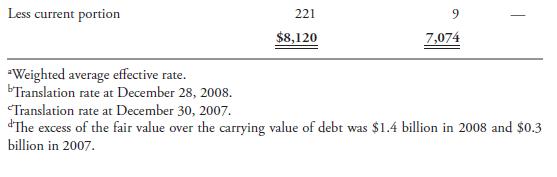

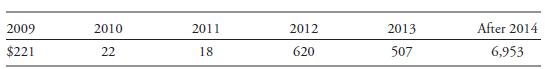

Exhibit 1 is an excerpt from Note 6 of Johnson & Johnson’s (NYSE: JNJ) 2008 financial statements that illustrates financial statement disclosure for long-term debt, including type and nature of long-term debt, effective interest rates, and required payments over the next five years. Johnson & Johnson reports its debt at amortised cost.

The Company has access to substantial sources of funds at numerous banks worldwide. In September 2008, the Company secured a new 364-day and 5-year Credit Facility. Total credit available to the Company approximates $7.7 billion of which $6.3 billion expires September 24, 2009, and $1.4 billion expires September 25, 2013. Interest charged on borrowings under the credit line agreements is based on either bids provided by banks, the prime rate or London Interbank Offered Rates (Libor), plus applicable margins. Commitment fees under the agreements are not material.

. . .

Aggregate maturities of long-term obligations commencing in 2007 are (dollars in millions):

Use the information in Exhibit 1 to answer the following questions:

1. Why are the effective interest rates unchanged from 2007 and 2008 for the first 11 borrowings listed?

2. Why does the carrying amount of the “4.95% Debentures due 2033” remain the same in 2007 and 2008?

3. Why does the carrying amount of the “4.75% Notes due 2019” decrease from 2007 to 2008?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie