If Karp had used FIFO instead of LIFO, which of the following ratios computed as of 31

Question:

If Karp had used FIFO instead of LIFO, which of the following ratios computed as of 31 December 2009 would most likely have been lower?

A. cash ratio

B. current ratio

C. gross profit margin

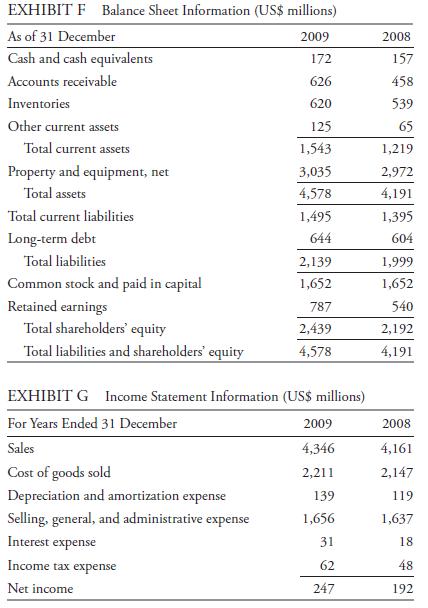

John Martinson, CFA, is an equity analyst with a large pension fund. His supervisor, Linda Packard, asks him to write a report on Karp Inc. Karp prepares its financial statements in accordance with U.S. GAAP. Packard is particularly interested in the effects of the company’s use of the LIFO method to account for its inventory. For this purpose, Martinson collects the financial data presented in Exhibits F and G.

Martinson finds the following information in the notes to the financial statements:

• The LIFO reserves as of 31 December 2009 and 2008 are $155 million and $117 million,

respectively; and

• The effective income tax rate applicable to Karp for 2009 and earlier periods is 20%.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie