Moodys considers a number of items when assigning credit ratings for the global aerospace and defense industry,

Question:

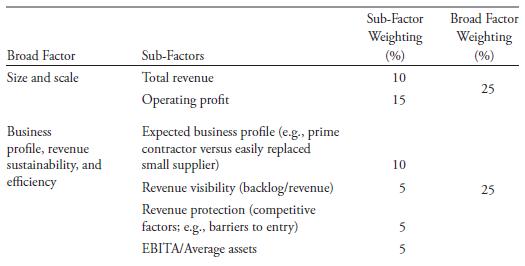

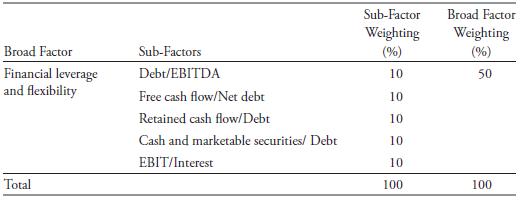

Moody’s considers a number of items when assigning credit ratings for the global aerospace and defense industry, including quantitative measures of three broad factors: size and scale; business profile, revenue sustainability, and efficiency; and financial leverage and flexibility. A company’s ratings for each of these factors are weighted and aggregated in determining the overall credit rating assigned. The broad factors, the sub-factors, and weightings are as follows:

1. What are some reasons why Moody’s may have selected these three broad factors as being important in assigning a credit rating in the aerospace and defense industry?

2. Why might financial leverage and flexibility be weighted so heavily?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie