MTR Gaming Group, Inc. (NasdaqGS: MNTG) disclosed the following information in one of the footnotes to its

Question:

MTR Gaming Group, Inc. (NasdaqGS: MNTG) disclosed the following information in one of the footnotes to its financial statements: “Interest is allocated and capitalized to construction in progress by applying our cost of borrowing rate to qualifying assets.

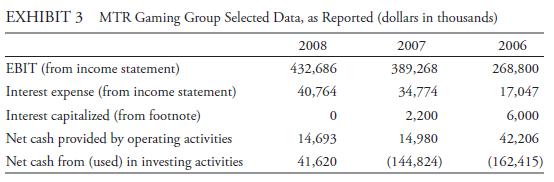

Interest capitalized in 2007 and 2006 was $2.2 million and $6.0 million, respectively.

There was no interest capitalized during 2008.”(Form 10-K filed 13 March 2009).

1. Calculate and interpret MTR’s interest coverage ratio with and without capitalized interest. Assume that capitalized interest increases depreciation expense by $475 thousand in 2008 and 2007, and by $365 thousand in 2006.

2. Calculate MTR’s percentage change in operating cash flow from 2006 to 2007 and from 2007 to 2008. Assuming the financial reporting does not affect reporting for income taxes, what were the effects of capitalized interest on operating and investing cash flows?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie