You are working on a project involving the analysis of JHH Software, a (hypothetical) software development company

Question:

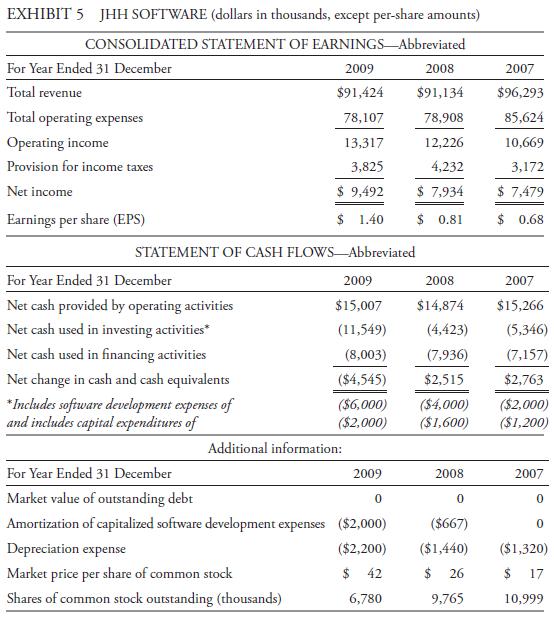

You are working on a project involving the analysis of JHH Software, a (hypothetical) software development company that established technical feasibility for its first product in 2007. Part of your analysis involves computing certain market-based ratios, which you will use to compare JHH to another company that expenses all of its software development expenditures. Relevant data and excerpts from the company’s annual report are included in Exhibit 5.

Footnote disclosure of accounting policy for software development:

Expenses that are related to the conceptual formulation and design of software products are expensed to research and development as incurred. The company capitalizes expenses that are incurred to produce the finished product after technological feasibility has been established.

1. Compute the following ratios for JHH based on the reported financial statements for fiscal year ended 31 December 2009, with no adjustments. Next, determine the approximate impact on these ratios if the company had expensed rather than capitalized its investments in software. (Assume the financial reporting does not affect reporting for income taxes. There would be no change in the effective tax rate.)

A. P/E: Price/Earnings per share

B. P/CFO: Price/Operating cash flow per share

C. EV/EBITDA: Enterprise value/EBITDA, where enterprise value is defined as the total market value of all sources of a company’s financing, including equity and debt, and EBITDA is earnings before interest, taxes, depreciation, and amortization.

2. Interpret the changes in the ratios.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie