On April 12, 2017, UK-based retailer Tesco plc presented its financial statements for the fiscal year ending

Question:

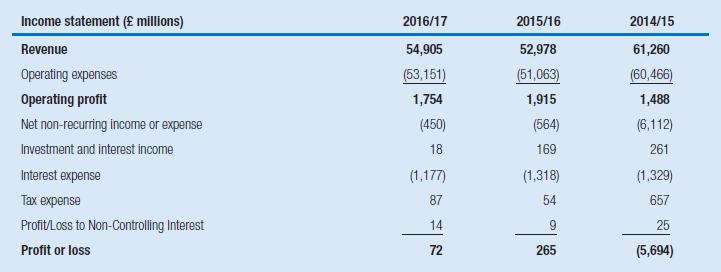

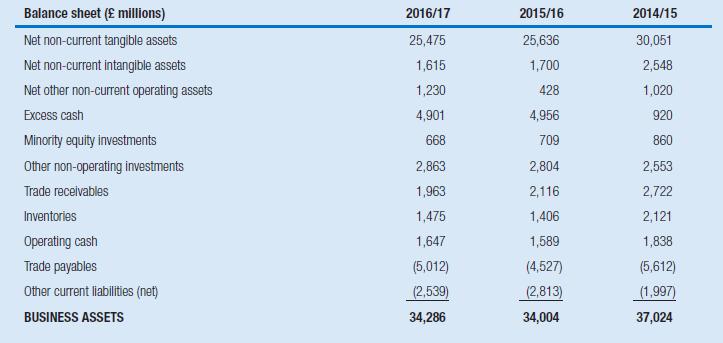

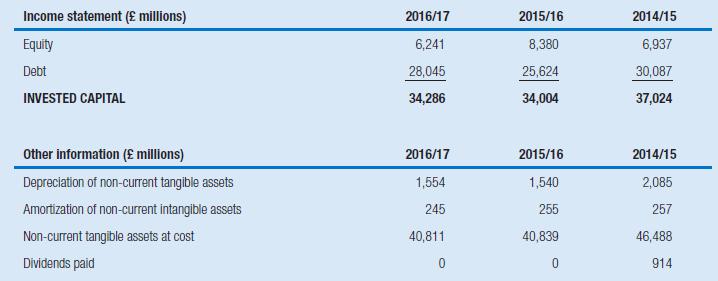

On April 12, 2017, UK-based retailer Tesco plc presented its financial statements for the fiscal year ending on February 28, 2017, announcing its first annual increase in like-for-like sales in seven years. The following tables show a selection of Tesco’s (standardized and adjusted) financial figures for the fiscal years 2014/2015, 2015/2016, and 2016/2017 (i.e., the fiscal years ending on February 28, 2015, 2016, and 2017, respectively):

In 2014/2015 non-recurring expense included

(a) a £4.7 billion impairment of property, plant, and equipment,

(b) a restructuring charge of £0.6 billion,

(c) a £0.7 billion impairment of non-operating investments, and

(d) a £0.2 billion reversal of commercial income overstated in prior years. Adjustments have been made to the financial statements such that “other non-operating investments” include the net assets of Tesco Bank (£2.2, £2.4, and £2.5 billion in 2014/2015, 2015/2016, and 2016/2017, respectively)

and “investment income” includes Tesco Bank’s pretax profit (£194, £161, and £77 million in 2014/2015, 2015/2016, and 2016/2017). Consequently, all other assets are those used in Tesco’s retailing activities; further, revenue and operating expenses are those arising from Tesco’s retailing activities.

In addition to disclosing the financial statements, Tesco’s management also provided guidance about future investment plans, financing strategies, and performance expectations. In particular, the following information became available to investors and analysts on the publication date:

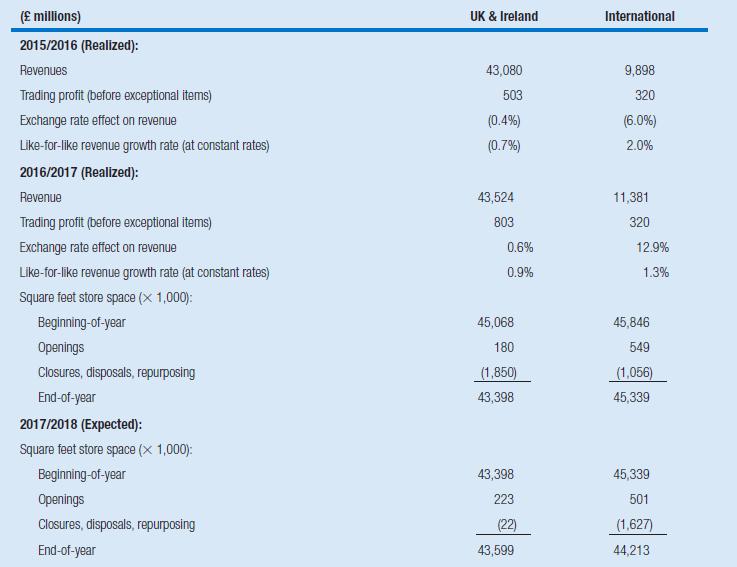

● In 2016/2017, Tesco opened 729 thousand square feet of new store space but closed or repurposed a substantially larger amount of store space, that is, 2.9 million square feet. The retailer plans to open 724 thousand square feet of new store space in 2017/2018 and, again, close or repurpose a larger amount of store space of 1.65 million square feet, thereby aiming to replace underperforming stores.

● Group capital expenditure during 2016/2017 was £1.13 billion (of which £0.73 billion had been spent in the United Kingdom and Ireland), slightly up from £0.93 billion in 2015/2016. Tesco’s management provided no information on expected capital expenditure in 2017/2018. Assuming that new store space were equally expensive as in 2016/2017, 2017/2018 capital expenditures would probably be close to £1.3 billion.

● Tesco’s effective tax rate was 32.4 percent (adjusted for one-time items); this effective tax rate may have been somewhat distorted by the fact that Tesco’s pre-tax profit was relatively low (close to zero). The statutory tax rate was 20 percent.

● In 2016/2017 Tesco made substantial repayments on its borrowings. Net cash flows from borrowings amounted to 2£1.85 billion (versus -£0.74 billion in 2015/2016). However, the retailer’s debt-to-capital ratio increased because of a £3.4 billion increase in its net pension obligation, following a significant drop in the company’s pension discount rate from 3.8 to 2.5 percent.

Management decided to adjust its approach for setting the pension discount rate in 2017/2018, which would lead to a 0.3 percentage point increase in the pension discount rate. In the notes to the 2016/2017 financial statements, Tesco’s management disclosed that a 0.1 percent increase in the discount rate corresponds with a £0.5 billion decrease in the net pension obligation.

● Management targets to have a net operating profit margin (before tax) of 3.5 to 4.0 percent by 2018/2019.

Management also disclosed information about revenue, like-for-like growth rates, and realized and planned store openings (see table).

1 Predict Tesco’s 2017/2018 revenue using the information about the company’s store space, revenues, and like-for-like growth (per geographical segment).

2 Predict the 2017/2018 book values of Tesco’s net non-current operating assets, operating working capital, and investment assets using the information about the company’s investment plans.

Make simplifying assumptions where necessary.

3 Estimate Tesco’s 2017/2018 net operating profit after tax, net investment profit after tax, interest expense after tax, and debt-to-equity ratio using the preceding information.

4 Early in 2015 Tesco’s management indicated that “future dividends will be considered within the context of the performance of the group, free cash flow generation and the level of indebtedness.”

What do the preceding estimates (and your estimate of Tesco’s 2017/2018 tax expense)

imply for the company’s free cash flow to equity holders in 2017/2018? If Tesco targets a cash percentage of 3 percent of revenue, how likely is it that Tesco will be able to pay dividends and/or reduce its debt in 2017/2018?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu