On June 24, 2015, two grocery retailers, Netherlandsbased Ahold and Belgium-based Delhaize, announced their intention to engage

Question:

On June 24, 2015, two grocery retailers, Netherlandsbased Ahold and Belgium-based Delhaize, announced their intention to engage in a merger of equals. By merging their activities, the two companies hoped to achieve €500 million of annual cost savings as well as increase their market power in the United States, where they earned about 60 percent of their revenues.

The merger of the two companies would create the fourth largest grocery retailer in Europe and the fifth largest grocery retailer in the United States. The terms of the deal implied that Delhaize shareholders would receive 4.75 Ahold shares in exchange for each of their shares. Further, Ahold would return €1 billion to its shareholders before completion of the merger with Delhaize, as a consequence of which Ahold shareholders would own close to 61 percent of all shares after the merger. For comparison, at the end of fiscal year 2014, Ahold’s total assets comprised only about 54 percent of the two companies’ assets combined;

similarly, Ahold’s book equity comprised about 47 percent of combined book equity.

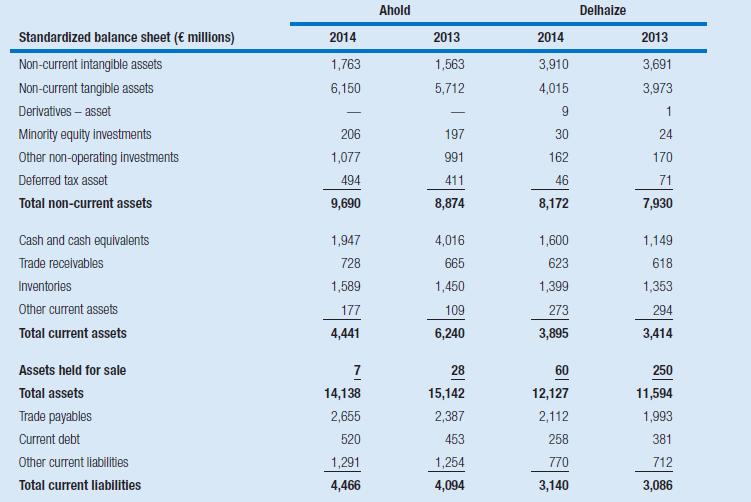

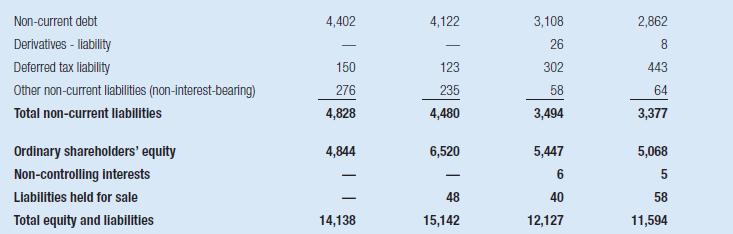

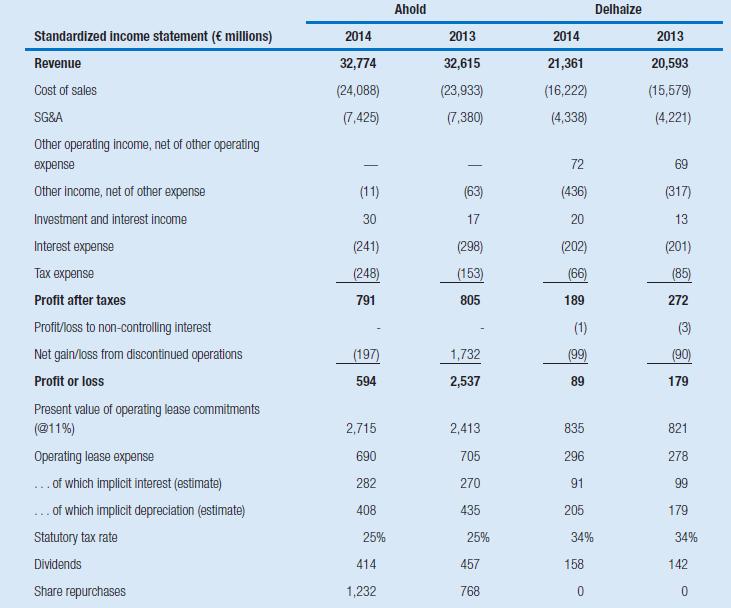

Using Ahold’s and Delhaize’s financial statements, an analyst prepared the following set of standardized statements. To better understand the differences between and similarities of the two merging companies as well as understand why Ahold shareholders would receive a larger stake in the combined company than Delhaize shareholders, the analyst wanted to compare the pre-merger performance of both companies. She had jotted down a few notes that could help her to interpret the numbers:

● In 2014 and 2013 Ahold’s (Delhaize’s) investment property had a book value of €560 and €543 million (€84 and €100 million), respectively.

● At the end of fiscal 2013 Ahold held an amount of €1,467 million in short-term deposits after having sold its 60 percent equity stake in the Swedish supermarket chain ICA. In 2014 Ahold used the proceeds of the ICA sale to increase its share buy-back program from €500 million to €2 billion.

● For both companies intangible assets have arisen from acquisitions in Europe and the United States.

● The total number of stores operated by Ahold amounted to 3,206 in 2014 and 3,131 in 2013;

Delhaize operated 3,468 stores in 2014 and 3,534 stores in 2013. Ahold had a workforce of 126 thousand full time equivalent (fte) in 2014 (123 thousand fte in 2013); Delhaize had a workforce of 114 thousand in 2014 (121 thousand fte in 2013).

1 Decompose Ahold’s and Delhaize’s returns on equity (ROE) in 2014 and 2013. Which economic or strategic factors may explain the observed differences in the components of ROE? Which factors may explain why Ahold shareholders received a majority stake in the new company?

2 On the day prior to the announcement, Ahold’s share price was €18.96. Based on this share price, the acquisition price for Delhaize amounted to €9,260 million. Prepare pro-forma financial statements and a pro-forma ROE decomposition for the combined company for fiscal 2014. When doing so, assume for simplicity that Delhaize’s assets and liabilities have been reported at their fair values and take into account the anticipated annual (pre-tax) cost savings of €500 million. What will be the effect of the merger on the companies’ ratios?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu