In 2009, following the worldwide credit crisis, several US-based car manufacturers, such as Chrysler and General Motors,

Question:

In 2009, following the worldwide credit crisis, several US-based car manufacturers, such as Chrysler and General Motors, approached bankruptcy and needed to be bailed out by the US government and private investors. Italy-based Fiat Group SpA. decided to help rescue Chrysler by acquiring 20 to 35 percent of the car manufacturer’s shares. In exchange, Fiat would get access to Chrysler’s vehicle platforms and manufacturing facilities, which could eventually help the Italian manufacturer re-enter the US market. Following the initial rumors about private negotiations between Fiat and Chrysler and Fiat’s (coinciding) announcement that it would not pay a dividend for 2008, Fiat’s share price dropped by more than 25 percent in one week. The question arose whether Fiat’s performance was really stronger than Chrysler’s.

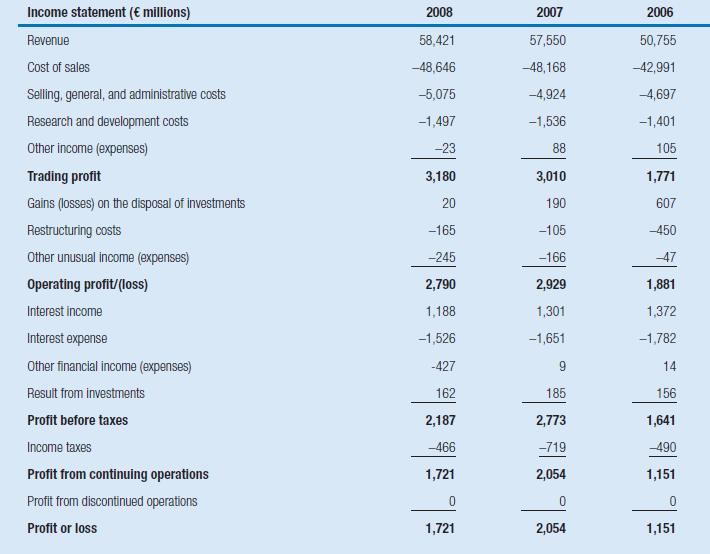

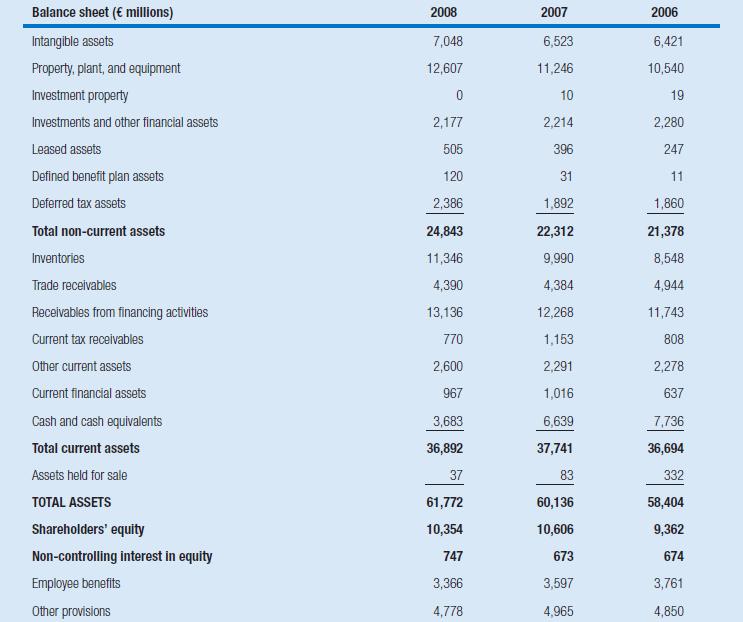

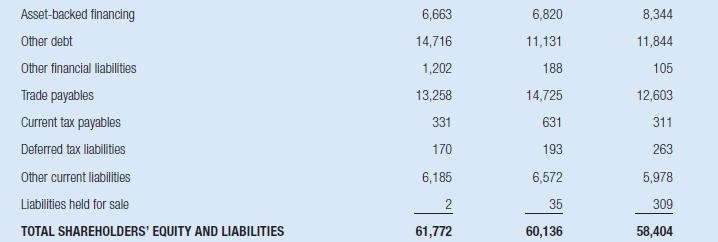

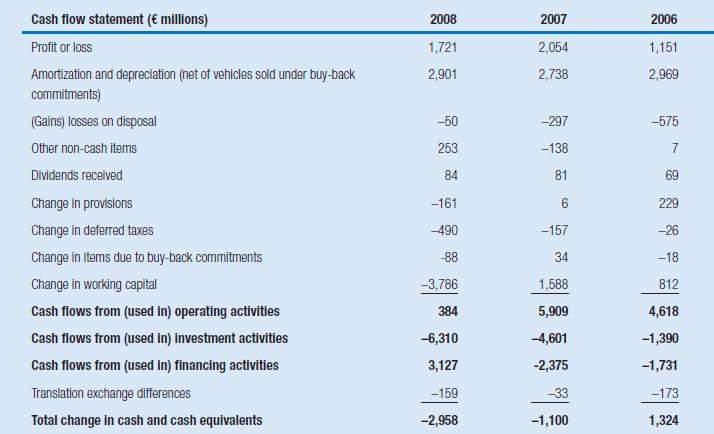

The following tables show the financial statements of the Fiat Group SpA. for the fiscal years 2006–2008.

In all three years, Fiat earned a return on equity in excess of 12 percent. Decompose Fiat’s return on equity and evaluate the drivers of the company’s performance during the period 2006–2008. What trends can you identify in the company’s performance?

What has been the likely effect of the credit crisis on Fiat? (To simplify the analysis, classify Fiat’s customer financing assets as non-operating investments; revenues of these financing activities are included in interest income.)

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu