Over the three years presented, changes in the valuation allowance for deferred tax assets were most likely

Question:

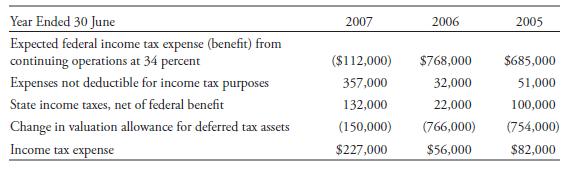

Over the three years presented, changes in the valuation allowance for deferred tax assets were most likely indicative of:

A. decreased prospect for future profitability.

B. increased prospects for future profitability.

C. assets being carried at a higher value than their tax base.

A company’s provision for income taxes resulted in effective tax rates attributable to loss from continuing operations before cumulative effect of change in accounting principles that varied from the statutory federal income tax rate of 34 percent, as summarized in the table below.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted: