Compared to the provision for income taxes in 2007, the companys cash tax payments were: A. lower.

Question:

Compared to the provision for income taxes in 2007, the company’s cash tax payments were:

A. lower.

B. higher.

C. the same.

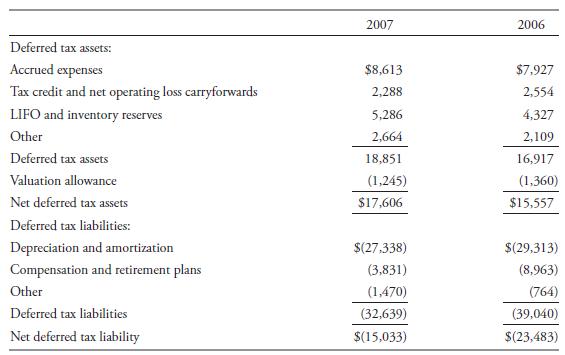

The tax effects of temporary differences that give rise to deferred tax assets and liabilities are as follows ($ thousands):

Transcribed Image Text:

Deferred tax assets: Accrued expenses Tax credit and net operating loss carryforwards LIFO and inventory reserves Other Deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities: Depreciation and amortization Compensation and retirement plans Other Deferred tax liabilities Net deferred tax liability 2007 $8,613 2,288 5,286 2,664 18,851 (1,245) $17,606 $(27,338) (3,831) (1,470) (32,639) $(15,033) 2006 $7,927 2,554 4,327 2,109 16,917 (1,360) $15,557 $(29,313) (8,963) (764) (39,040) $(23,483)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Based on the provided information we can analyze the companys deferred tax assets and liabilities for the years 2007 and 2006 However to directly answ...View the full answer

Answered By

Rohail Amjad

Experienced Finance Guru have a full grip on various sectors, i.e Media, Insurance, Automobile, Rice and other Financial Services.

Have also served in Business Development Department as a Data Anlayst

4.70+

32+ Reviews

83+ Question Solved

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The income tax note shown in NMBT's 2010 annual report is reproduced below. NMBT is a Connecticut bank with $300 million in assets. Net income of $2,792,000 was reported in 2010 ($2,159,000 in 2009)....

-

Consider the excerpts from the 2007 financial statements of Berkshire Hathaway shown below and on the next page to answer the following questions. 1. What was Berkshire Hathaways comprehensive income...

-

Discriminate the Enablers and the Inhibitors to IT strategy alignment from the below IT fails to meet commitments IT does not understand business IT involved in strategy development IT understands...

-

At retirement, a client has two payment options: a 20-year annuity at 50,000 per year starting after one year or a lump sum of 500,000 today. If the client's required rate of return on retirement...

-

Cloud computing is a term used to describe the delivery of information systems without, for example, the purchase of physical hardware or even software in some instances. What this means for an...

-

On 1 January 2026 Rachelle Zalmstra and Jay Muscat formed a partnership, agreeing to share profits and losses equally. Rachelle contributed \($185\) 300 in cash, and plant and equipment with a fair...

-

You are the auditor of Maglite Services Inc., a privately owned full-service cleaning company following ASPE that is undergoing its first audit for the period ending September 30, 2017. The bank has...

-

56. If the maximum concentration of PbCl2 in water is 0.01M at 298 K. Its maximum concentration in 0.1M NaCl will be : (1) 4 103 M x (3) 4 102 M (2) 0.4 10M x (4) 410 M

-

In 2007, the companys net income (loss) was closest to: A. ($217,000). B. ($329,000). C. ($556,000). A companys provision for income taxes resulted in effective tax rates attributable to loss from...

-

If the valuation allowance had been the same in 2007 as it was in 2006, the company would have reported $115 higher : A. net income. B. deferred tax assets. C. income tax expense. The tax effects of...

-

How could economic instruments be used to reduce pollution from non-point sources in an estuary? In what way does the nature of the pollution source impose additional policy design problems for the...

-

CoursHeroTranscribedText Prepare journal entries to record items (a) through (f) above [ignore item (g) for the moment]. (If no entry is required for a transaction/event, select "No journal entry...

-

This morning (9 June 2021) siri purchased a j2 =2% p.a. AustralianTreasury bond, maturing on 9 June 2031. Siri is liable for 17% tax oninterest and capital gains. Assume such tax is paid immediately...

-

1. prepare the consolidation worksheet entries for December 31, 2021; 2. prepare the consolidation worksheet entries for December 31, 2022. Assuming during 2022, Sierra reports net income of 200,000...

-

A 3 year bond has semiannual coupons of 11% per annum. The continuously compounding yield is 15%. The bond has a face value of $200. You will be pricing the bond initially, and at future times...

-

There is a dwarfing allele (D) in White Leghorn chickens, which reduces body size from 5 lbs (DD, DD) to 3 lbs (DD) on average. There is also a reduction in the annual egg production from 290...

-

Why is the impact of scheduling and resource allocation more significant in multi-project organizations?

-

Velshi Printers has contracts to complete weekly supplements required by fortysix customers. For the year 2018, manufacturing overhead cost estimates total $600,000 for an annual production capacity...

-

The new owners of Indomie Foods Inc. have hired you to help them diagnose and cure problems that the company has had in maintaining adequate liquidity. As the first step, you perform a liquidity...

-

Ahmad Nazri, the CEO of 1MDB Inc., has a proposal to present to his board of directors pertaining to a power plant expansion that will cost $50 million. He is, however, unsure whether the planned...

-

Hong Hong Printing Company has sales totaling $40,000,000 in fiscal year 2012. Some of the ratios for the company are listed below. Use this information to determine the dollar values of the various...

-

During the 2023 FBT year, Mt Barker Brewing (MBB) provided the following benefits to employees: Laptop computer costing $1,300 Concert tickets costing $200 Water filter system costing $1,500 All...

-

Kate has an individual RESP for her daughter, Macy which was opened 20 years ago. Macy, age 32 passed away in a car accident this year. Current RESP breakdown: Contribution: $100,000 Canada Education...

-

Hamish Carter is employed as a parking attendant at Crowne Metro Hotel. During the 2023 income year, Hamish received the following amounts: Net Wages from Crowne (PAYGW of $11,000) $59,000 Tips from...

Study smarter with the SolutionInn App